LongRiverTech Consulting: International Financial Core Software System

The international financial core software system is mainly composed of multiple key components and systems, which play a vital role in the global financial field.

The international financial core software system covers core banking solutions, exchange trading solutions, investment management systems, trading and investment accounting systems, financial information transmission systems, and payment and clearing systems.

These systems together constitute the cornerstone of the modern financial system and ensure the smooth progress of global financial transactions.

The financial core software system is the foundation of the operation of financial institutions. It supports various businesses of financial institutions such as banks, insurance companies, and securities companies.

These systems usually include functional modules such as customer relationship management, account processing, risk management, and transaction processing to ensure the smooth operation of financial services.

The financial core software system is the infrastructure for the operation of financial institutions,

and integrates a variety of business processing and decision support functions.

The financial core software system has a decisive impact on the operating efficiency, risk control, and customer service quality of financial institutions.

Financial core software systems support the liquidity and stability of global financial markets by efficiently processing transactions and data.

Financial core software systems help financial institutions comply with global financial regulatory requirements through risk management and compliance support.

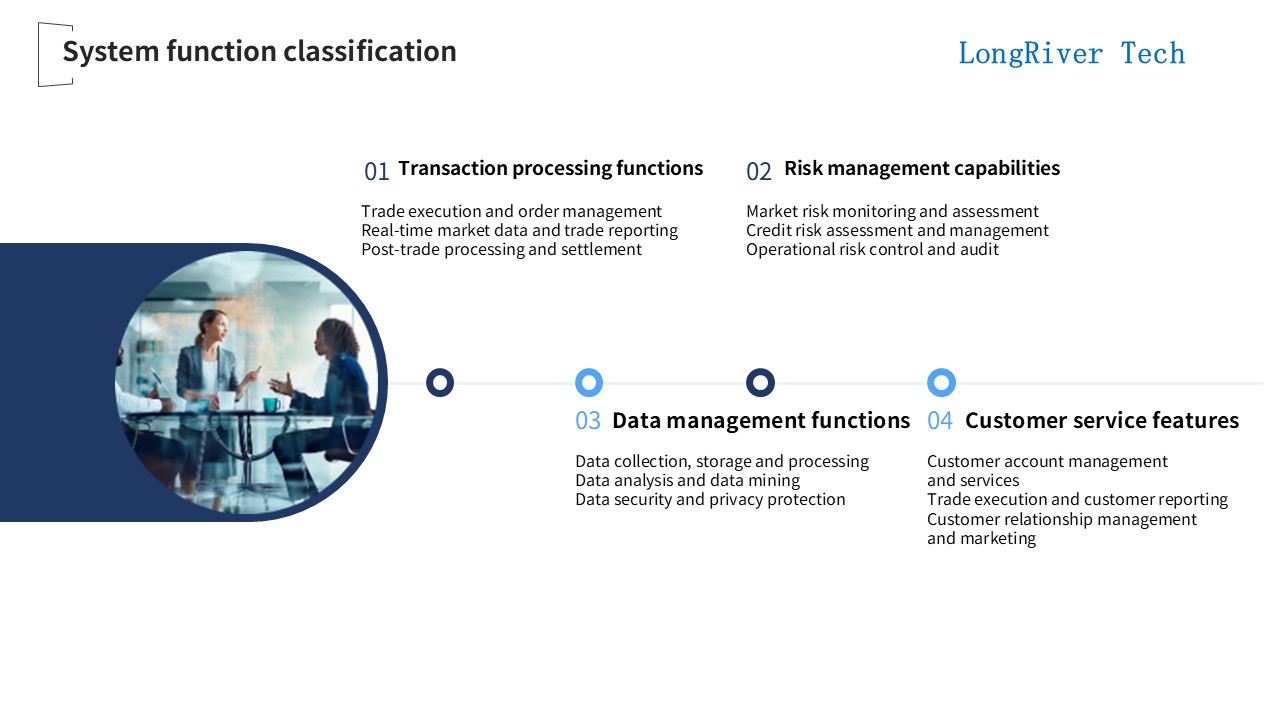

The main functions of international financial core software systems are: transaction processing function, risk management function, data management function and customer service function.

Transaction processing functions include: transaction execution and order management, real-time market data and transaction reports, post-transaction processing and settlement.

Risk management functions include: market risk monitoring and assessment, credit risk assessment and management, operational risk control and auditing.

Data management functions include: data collection, storage and processing, data analysis and data mining, data security and privacy protection.

Customer service functions include: customer account management and service, transaction execution and customer reporting, customer relationship management and marketing.

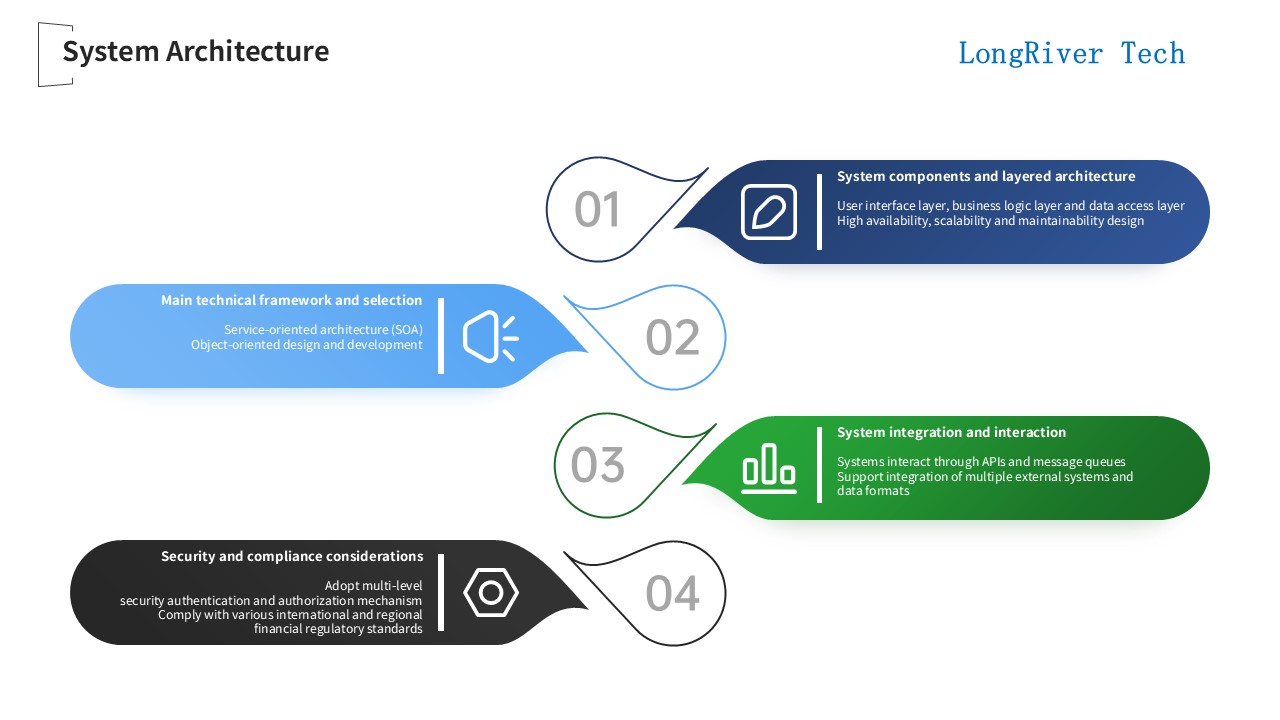

The international financial core software system architecture mainly needs to consider: system components and layered architecture, main technical framework and selection, system integration and interaction methods, security and compliance considerations.

The system components and layered architecture mainly include: user interface layer, business logic layer and data access layer, high availability, scalability and maintainability design.

The main technical frameworks and choices include: service-based architecture (SOA), object-oriented design and development.

The main considerations for system integration and interaction methods are: interaction between systems through APIs and message queues, support for integration of multiple external systems and data formats.

Security and compliance considerations include: adopting multi-level security authentication and authorization mechanisms, and complying with various international and regional financial regulatory standards.

The key technologies and innovations of the international financial core software system are reflected in multiple levels, from the application of basic technologies to the transformation of service models, to the improvement of security and customer experience, which jointly promote the continuous progress of the financial industry.

The key technologies of the international financial core software system include: cloud computing technology, big data technology, artificial intelligence technology, blockchain technology, and mobile payment technology.

The innovations of the international financial core software system include: innovation of service models, enhancement of security, upgrade of architecture, integration of technologies, and improvement of customer experience.

The applications of blockchain technology in the core software system of international finance include: decentralized transaction processing, application of smart contracts in risk management, advantages of distributed ledgers in data management, and integration of cryptocurrency and traditional financial systems.

Decentralized transaction processing can improve transaction efficiency, reduce transaction costs, and enhance data security.

The applications of smart contracts in risk management include: automated execution of contract terms, reduced risk of legal disputes, and increased cost of default.

The advantages of distributed ledgers in data management include: preventing data tampering, improving data transparency, and enhancing data synchronization speed.

The integration of cryptocurrency and traditional financial systems can provide new asset classes, innovate cross-border payment methods, and promote financial inclusion.

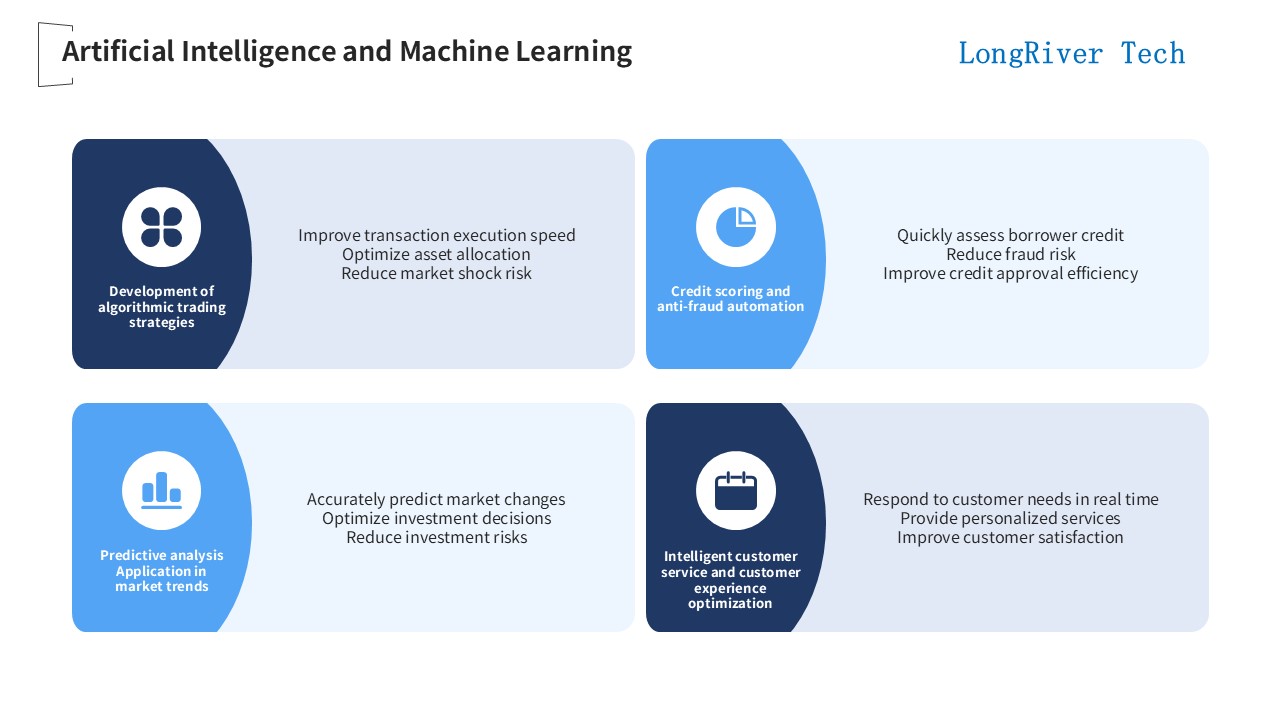

The applications of artificial intelligence and machine learning in the core software system of international finance include: development of algorithmic trading strategies, credit scoring and anti-fraud automation, application of predictive analysis in market trends, intelligent customer service and customer experience optimization.

The development of algorithmic trading strategies can improve transaction execution speed, optimize asset allocation, and reduce market impact risks.

Credit scoring and anti-fraud automation can quickly assess borrower credit, reduce fraud risks, and improve credit approval efficiency.

The application of predictive analysis in market trends includes: accurately predicting market changes, optimizing investment decisions, and reducing investment risks.

Intelligent customer service and customer experience optimization support real-time response to customer needs, providing personalized services, and improving customer satisfaction.

The industry application case analysis shows the application of international financial core software systems in different scenarios, and how to solve practical business challenges through technological innovation to improve the quality and efficiency of financial services.

The multinational banking system case involves a global banking network covering multiple countries and regions.

The system is designed to support the daily operations of banks, including transaction processing, risk management and compliance requirements.

The key challenges of system implementation are:

Ensure smooth deployment and unified operation worldwide.

Comply with laws, regulations and financial standards of different countries and regions.

Integrate various existing local systems and technical infrastructures.

The system upgrade and maintenance strategy is:

Regularly evaluate and upgrade the system to cope with changing technical and business needs.

Implement continuous maintenance and troubleshooting to ensure high availability and stability of the system.

Adopt modular design to facilitate phased upgrade and maintenance.

After the system upgrade, the bank's transaction processing speed and accuracy have significantly improved.

Business process automation has brought cost savings and improved operational efficiency.

Ability to support new financial services and products, promoting revenue growth.

The hedge fund management system case covers a modern hedge fund focusing on quantitative trading.

The core functions of the system include transaction execution, portfolio management and risk analysis.

The hedge fund management system uses machine learning and artificial intelligence technologies to optimize the investment decision-making process.

Implement algorithmic trading and intelligent routing to improve transaction execution efficiency.

Dynamic risk management framework to monitor and manage portfolio risks in real time.

Customized algorithm and model implementation for quantitative trading strategies.

Real-time data processing and analysis capabilities to support rapid decision-making.

Customized reporting and analysis tools to meet investor reporting needs.

Through technology-driven investment strategies, the fund has achieved significant investment returns.

Systematic risk management has helped the fund avoid risk events in multiple markets.

Automated and standardized operating processes reduce human errors and operational risks.

The payment system case revolves around a global payment processing platform that serves many merchants and consumers.

The system needs to handle multiple payment methods, including bank direct transactions, UnionPay transactions, WeChat Pay, Alipay, credit cards, e-wallets and transfer services.

The cross-border payment and settlement function supports multiple currencies and cross-border payment processes to meet the needs of global transactions.

Provide real-time payment settlement to ensure that transactions are completed quickly.

Built-in compliance checks to comply with anti-money laundering and sanctions regulations of various countries.

The payment system uses the latest encryption technology to protect the security of transaction data.

Implement fraud detection and prevention mechanisms to reduce payment risks.

Leverage cloud infrastructure to provide highly available payment services.

The implementation of the payment system case has significantly increased market share and attracted more merchants and users.

By optimizing the user interface and process, the user experience and satisfaction have been significantly improved.

The high performance and reliability of the system promote brand trust and loyalty.

The future development trends of international financial core software systems are mainly focused on the application of intelligence, cloud computing, big data and blockchain technology,

while the challenges are mainly reflected in data security and privacy protection, regulatory compliance, technology updates and maintenance, system integration and compatibility, and talent recruitment and training.

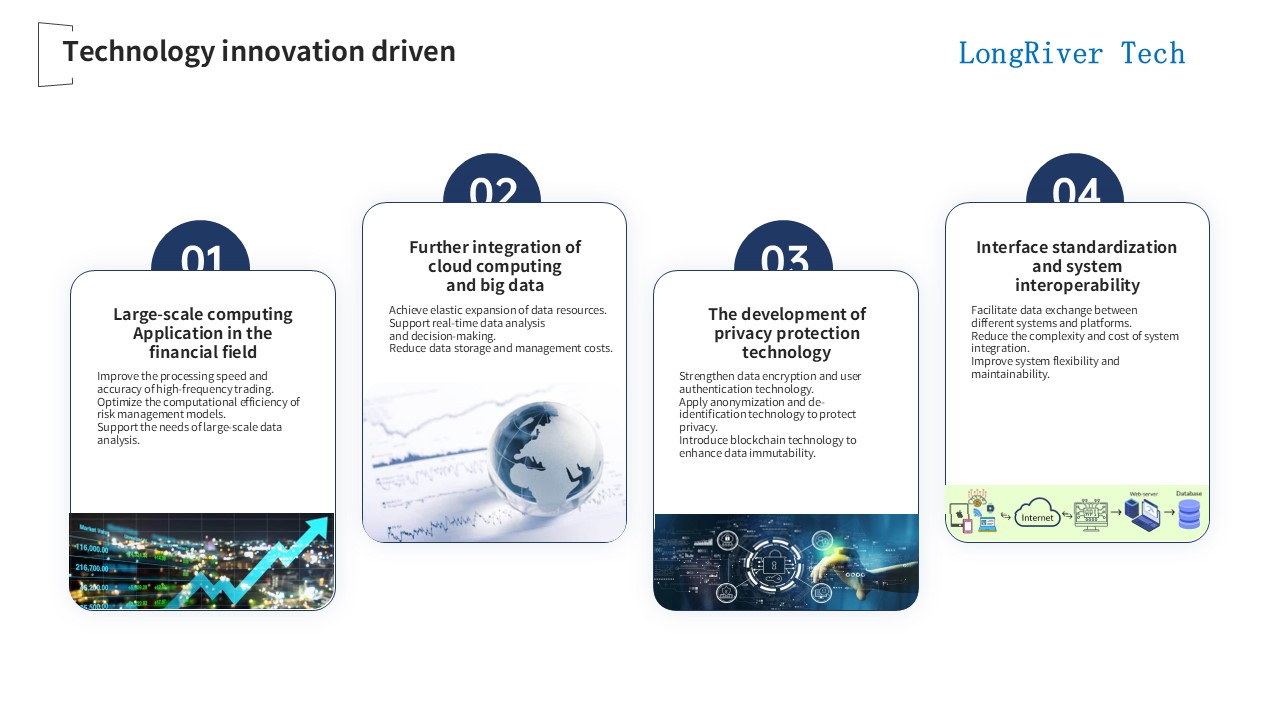

Technology innovation drive of international financial core software system includes: application of large-scale computing in the financial field, further integration of cloud computing and big data, development of privacy protection technology, interface standardization and system interoperability.

The application of large-scale computing in the financial field improves the processing speed and accuracy of high-frequency transactions, optimizes the computing efficiency of risk management models, and supports the needs of large-scale data analysis.

The further integration of cloud computing and big data realizes the elastic expansion of data resources, supports real-time data analysis and decision-making, and reduces data storage and management costs.

The development of privacy protection technology includes: strengthening data encryption and user identity authentication technology, applying anonymization and de-identification technology to protect privacy, and introducing blockchain technology to enhance data immutability.

Interface standardization and system interoperability promote data exchange between different systems and platforms, reduce the complexity and cost of system integration, and improve the flexibility and maintainability of the system.

Changes in the regulatory environment of international financial core software systems include: global financial regulatory policy trends, the development of compliance technology (RegTech), compliance with anti-money laundering and anti-terrorist financing regulations, and advances in financial crime monitoring technology.

Global financial regulatory policy trends include: following stricter capital adequacy requirements, complying with international anti-money laundering and counter-terrorist financing regulations, and adapting to cross-border data protection and privacy regulations.

The development of compliance technology (RegTech) can use artificial intelligence and machine learning for compliance monitoring, automate reporting and audit processes to reduce human errors, and improve the efficiency and accuracy of compliance management.

Compliance with anti-money laundering and counter-terrorist financing regulations can implement customer identification and transaction monitoring systems, use behavioral analysis technology to identify abnormal transaction patterns, and strengthen internal controls and compliance training.

Advances in financial crime monitoring technology use big data technology to analyze transaction data to detect anomalies, use advanced algorithms to predict and prevent financial crimes, and strengthen collaboration and information sharing with other law enforcement agencies.

The analysis of the international financial core software system market and competition landscape includes: the impact of financial technology innovation on traditional banks, the competitive situation of financial technology companies, cross-border cooperation and ecosystem construction, changes in customer demand and service model innovation.

The impact of financial technology innovation on traditional banks includes: traditional banks accelerate digital transformation to maintain competitiveness, non-bank financial institutions provide more traditional banking services, and customers' demand for digital services and products continues to grow.

The competitive situation of fintech companies is manifested in the following aspects: fintech start-ups continue to emerge, large technology companies expand their business scope through financial services, and traditional financial institutions and fintech companies intensify their cooperation.

Cross-border cooperation and ecosystem construction include: cooperation and resource sharing between financial institutions, cross-border cooperation to provide comprehensive financial solutions, and building a customer-centric service ecosystem.

Changes in customer demand and innovation in service models include: customers' demand for personalized and customized services has increased, the popularity of mobile payments and digital wallets has changed payment habits, and financial services pay more attention to user experience and interaction.

In short, the international financial core software system is moving towards intelligence, cloud computing, data-driven and blockchain integration, while facing multiple challenges such as security, compliance, technology updates and talent.