LongRiverTech Consulting: Industrial Groups and Financial Markets

Industrial groups and financial markets are interdependent and mutually reinforcing.

Financial markets provide industrial groups with a platform for financing and risk management, while the participation of industrial groups enhances the vitality and stability of financial markets.

Industrial groups use financial markets for financing to promote industrial development and capital appreciation.

Industrial groups are a collection of enterprises that classify individual stocks or individual companies into one category based on a common business industry.

They usually appear in the context of large-scale socialized production, specialized division of labor, and increasingly fierce market competition. They are the product of the continuous expansion of corporate business scale and avoidance of antitrust law restrictions.

Industrial groups are economic associations composed of multiple enterprises and institutions with legal person status, aiming to give full play to group advantages, create greater productivity, and achieve economies of scale.

The member units of the group independently exercise their rights, assume obligations and responsibilities, which is conducive to dispersing business risks.

The head office or management agency of the group implements unified management and coordination of the business activities of member units to improve efficiency and benefits.

The components of the industrial group include: core business of the enterprise, subsidiaries and branches, and upstream and downstream integration of the industrial chain.

The main characteristics of the industrial group are: economies of scale, resource integration capabilities, and cross-industry operations.

The business strategy of industrial groups is a series of plans and actions formulated by the group to achieve long-term development goals.

The business strategy of industrial groups should focus on clarifying development goals, implementing resource integration and sharing, promoting collaborative innovation, optimizing member management, formulating differentiated competition strategies, expanding market channels and strengthening risk management.

These strategic measures help to enhance the overall competitiveness and market position of industrial groups.

The business models of industrial groups include: diversification strategy, vertical integration, and market orientation.

The competitive strategies of industrial groups include: price competition, product differentiation, and innovation capabilities.

The financial management of industrial groups is a complex and important system project, which involves fund raising, budget control, cost accounting, and profit distribution.

The capital structure of an industrial group usually needs to consider debt financing, equity structure, and capital expansion strategy.

The capital operation of an industrial group includes internal financing, external borrowing, and investment decisions.

The financial risk management of an industrial group includes risk assessment, risk hedging, financial crisis response, and internal control systems.

The financial market refers to the general term for places that operate monetary funds borrowing, foreign exchange trading, securities trading, the issuance of bonds and stocks, and the trading of precious metals such as gold.

This market can directly or indirectly provide financing opportunities for capital demanders and investment channels for capital suppliers, and is an important platform for capital financing.

The trading objects of the financial market are currency and various financial instruments, such as stocks and bonds.

The components of the financial market are: financial assets, financial participants, and financial transactions.

The main functions of the financial market include: capital financing, risk management, and price discovery.

The financial market can be classified from multiple perspectives:

According to the financing period, it can be divided into short-term financial markets and long-term financial markets.

Short-term financial market is the money market: including bill discount market, short-term deposit and loan market, short-term bond market and inter-financial institution lending market, etc., usually a financing market within one year.

Long-term financial market is the capital market: including long-term loan market and securities market, usually involving financing for more than one year.

Derivatives market includes futures, options, etc.

By transaction object: including local currency market (money market and capital market), foreign exchange market, gold market, securities market, etc.

By financing method: can be divided into direct financing market and indirect financing market.

By geographical scope: can be divided into domestic financial market and international financial market.

The operating mechanism of financial market includes: supply and demand mechanism, price mechanism, and regulatory mechanism.

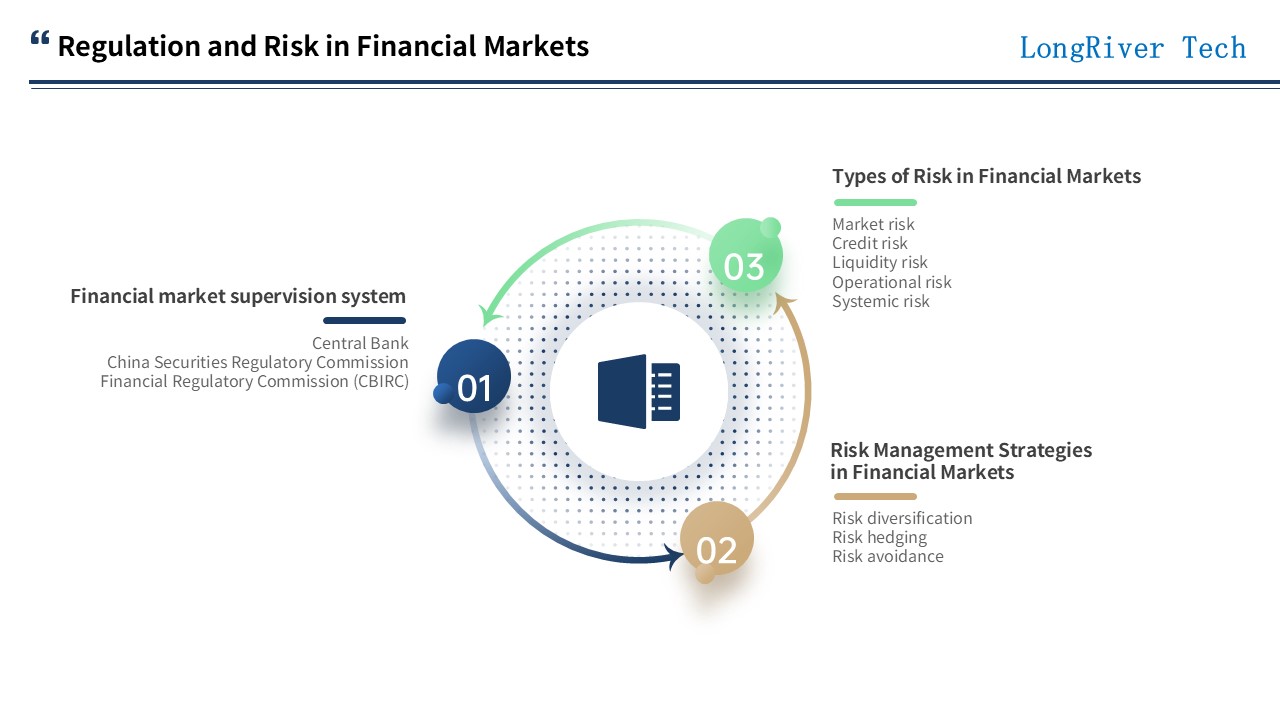

Financial market supervision is the key to ensure market stability, fairness, transparency and effective operation, while risk management is an important task that financial market participants must face.

The regulatory system of financial market is composed of the central bank, the China Securities Regulatory Commission and the Financial Regulatory Bureau (China Banking and Insurance Regulatory Commission).

The risk types of financial market are divided into: market risk, credit risk, liquidity risk, operational risk and systemic risk.

Risk management strategies in the financial market include: risk diversification, risk hedging, and risk avoidance.

There is a close interactive relationship between industrial groups and financial markets, which is reflected in multiple levels and has a profound impact on the development of both parties.

The support and promotion of industrial groups by the financial market include: providing financing channels, optimizing resource allocation, and providing risk management tools.

The impact of industrial groups on the financial market includes: increasing investment opportunities, enhancing the activity of financial markets, and promoting financial innovation.

Industrial groups raise funds by issuing securities such as stocks and bonds.

Industrial groups can also obtain funds through loans from financial institutions and other financing methods.

The financing behavior of industrial groups affects the supply and demand of funds in the financial market.

Industrial groups invest in the financial market to obtain higher returns.

The investment behavior of industrial groups affects the asset prices and liquidity of the financial market.

The investment behavior of industrial groups can also provide financial support for their own development.

Financial markets provide financing channels for industrial groups to help them solve their funding needs.

Risk assessment and financial support of industrial groups by financial institutions are crucial to the development of industrial groups.

Financial market financial support has an impact on the expansion and innovation activities of industrial groups.

Financial markets constrain the behavior of industrial groups through supervision and compliance requirements.

Investors in financial markets supervise the operating conditions and financial conditions of industrial groups.

The constraint mechanism of financial markets helps to improve the operating efficiency of industrial groups and reduce risks.

Industrial groups and financial institutions can establish strategic partnerships to achieve resource sharing.

Industrial groups can jointly establish funds with financial institutions to carry out investment and financing activities.

Industrial groups and financial markets can improve the efficiency of financial services through financial technology cooperation.

Industrial groups should choose appropriate financial institutions and financial products according to their own development needs.

Industrial groups should strengthen information exchange and cooperation with financial institutions to improve the efficiency of capital use.

Industrial groups and financial markets should jointly promote industrial upgrading and economic development.

Industrial group financialization is a complex process that brings both development opportunities and challenges.

Industrial groups need to fully understand and respond to these challenges to ensure the steady development of financial business and promote continuous innovation of the overall business.

The motivations for the financialization of industrial groups include: high returns on capital operations, the promotion of diversification strategies, and the need for industrial upgrading.

The impacts of the financialization of industrial groups include: optimizing resource allocation, enhancing group competitiveness, and increasing financial risks.

The risks of industrial group financialization include: the transmission of credit risks, the hollowing out of the real economy caused by excessive financialization, and the adverse effects of financial market fluctuations on industrial groups.

Strategies to address the challenges of industrial group financialization include: establishing a risk prevention mechanism, optimizing the structure of financial assets, and strengthening internal control and compliance management.

The regulatory policy for the financialization of industrial groups needs to consider: strengthening cross-departmental regulatory cooperation, implementing classified supervision and dynamic supervision, and improving the legal and regulatory system.

The guiding policy of the financialization of industrial groups is mainly to guide capital to flow to the real economy, support industrial upgrading and innovation, and encourage the rational use of financial instruments.

With the continuous deepening of the global economy and the development of financial markets, the integration of industrial groups and financial markets has become an inevitable trend.

This integration not only helps industrial groups optimize the use of funds and reduce financing costs, but also provides them with more investment opportunities, thereby promoting the development of the overall business.

With the continuous development of financial technology, industrial groups will actively use technical means such as big data, artificial intelligence, and blockchain to improve the efficiency and accuracy of financial services and reduce operating costs.

The innovation and development of the financial market also includes: popularization of financial services, improving the coverage and convenience of financial services. Diversification of financial markets to meet market needs at different levels and types.

Along with the global layout of industrial groups, the international development of financial markets is also continuing to deepen.

The strengthening of international financial cooperation promotes global financial stability.

The expansion of cross-border financial business improves the efficiency of financial markets.

The changing trend of the foreign exchange market affects the global layout of industrial groups.

Financial markets support the transformation and upgrading of industrial groups.

The transformation of traditional industries to high-tech industries forms a service-oriented, personalized, intelligent development trend and a green, low-carbon, sustainable development model.

Financial markets support the global development of industrial groups.

The increase in cross-border mergers and acquisitions and cooperation expands the global influence of industrial groups.

The global layout of the industrial chain improves the competitiveness of industrial groups.

The internationalization of culture and brands enhances the international image of industrial groups.

The areas of cooperation between industrial groups and financial markets include:

Financing cooperation to improve the efficiency of capital utilization.

Risk management to jointly deal with market risks.

Investment cooperation to achieve a win-win situation for industry and finance.

The win-win strategies of industrial groups and financial markets include:

Binding interests to achieve long-term and stable cooperation between the two parties.

Differentiated services to meet the diverse financial needs of industrial groups.

Collaborative innovation to jointly explore new development opportunities.

In short, industrial groups and financial markets are closely linked, jointly promoting the deep integration and development of the real economy and financial capital.