LongRiverTech Consulting: Direct Market Access for financial markets and exchange

Direct financial market connections and exchange access are important components of the development of financial technology. They use technical means to achieve efficient connections and information exchange between all participants in the financial market, and promote the interconnection and business development of the financial market.

This introduction includes three parts: an overview of direct financial market connections, an overview of exchange access, and a combination of direct financial market connections and exchange access.

Direct financial market connections refer to the direct connection of financial institutions, trading platforms, clearing institutions, etc. through technical means to achieve real-time transmission and processing of data such as transaction instructions, settlement information, and fund transfers.

This connection method reduces the number of intermediate links, improves transaction efficiency and security, and reduces operating costs.

Direct connection refers to financial institutions directly connecting to exchanges through a dedicated network for transactions and data transmission.

Features include low latency, high security, high reliability, and efficient data processing capabilities.

Direct connection can reduce transaction costs, increase transaction speed and transparency.

Enhance financial institutions' control and responsiveness to the market and improve competitiveness.

Common direct connection implementation technologies include dedicated lines, virtual private networks, and cloud computing.

Financial institutions need to establish a stable network connection and deploy appropriate technical facilities.

The process and steps of direct connection include:

Selecting the appropriate exchange and connection method.

Establishing technical connection, testing and verification.

Officially launching and continuously monitoring and optimizing the connection.

The advantages of direct connection include:

Reducing transaction costs and improving transaction efficiency.

Enhancing transaction speed and transparency, and improving market competitiveness.

Providing more trading opportunities and flexibility.

The challenges faced by direct connection include:

The complexity of technical implementation and maintenance.

Security and stability challenges.

Exchange access refers to financial institutions, trading platforms, etc., through compliance processes and technical means, access to stock exchanges, futures exchanges and other trading venues, and participate in the trading and settlement of various financial products.

Exchange access refers to the process by which financial market participants directly connect to the exchange's system through technical means to realize functions such as trading, market conditions, and settlement.

Exchange access enables participants to obtain market information faster, improve trading efficiency and reduce trading costs.

Exchange access provides participants with the possibility of seamless connection with the exchange system, improving the overall trading experience.

Exchange access helps to improve market liquidity and promote the improvement of trading activity.

Exchange access provides participants with more trading opportunities and investment options, enhancing the competitiveness of the market.

Exchange access helps regulators better monitor the market and improve the transparency and fairness of the market.

Exchange access is usually divided into two methods: direct access and indirect access.

Direct access means that participants directly connect to the exchange's system and conduct transactions and other operations through the exchange's API.

Indirect access means that participants connect through a third-party service provider and conduct transactions and other operations through the third-party service provider's API.

The process of exchange access includes application for access, technical connection, test verification, and online operation.

Participants need to submit access applications to the exchange, and technical connection can only be carried out after review.

During the technical connection process, participants need to develop and connect the system in accordance with the technical specifications of the exchange.

Test verification is an important link to ensure the stability, reliability and security of the access system.

Technical difficulties may be encountered during exchange access, such as system docking and data transmission.

Exchange access needs to comply with strict regulatory requirements, and participants need to ensure the compliance of the system.

Exchange access may face risks in terms of network security and data security.

Exchanges should provide detailed technical documentation and technical support to help participants successfully complete technical docking.

Exchanges can establish training mechanisms to enhance participants' technical capabilities and regulatory compliance awareness.

Exchanges should strengthen network security protection to ensure the safe and stable operation of access systems.

The combination of direct financial market connection and exchange access is an important trend in the development of financial technology.

It directly connects financial institutions and exchanges to achieve efficient transmission and processing of trading instructions, market information, capital flows, etc.,

which greatly promotes the interconnection and business innovation of financial markets.

The impact of direct connection on exchange access includes:

Improve transaction efficiency

Reduce transaction costs

Enhance data security

The role of exchange access on direct connection includes:

Enrich transaction varieties

Improve transaction experience

Promote market competitiveness

With the continuous innovation of financial technology and the continuous opening of financial markets, the combination of direct connection and exchange access in the financial market will usher in a broader development prospect.

The integrated development of direct connection and exchange access can meet the needs of investors, optimize resource allocation, and improve market liquidity.

The focus of the integrated development of direct connection and exchange access is on technology innovation drive, win-win cooperation strategy, and standardized management.

In the future, the combination of direct connection and exchange access will pay more attention to cross-market and cross-institutional collaboration and information sharing, and promote the formation of a more open, inclusive and efficient financial market ecosystem.

At the same time, with the application and promotion of cutting-edge technologies such as blockchain and artificial intelligence, the combination model will also achieve new breakthroughs and improvements in transaction transparency, risk prevention and control, etc.

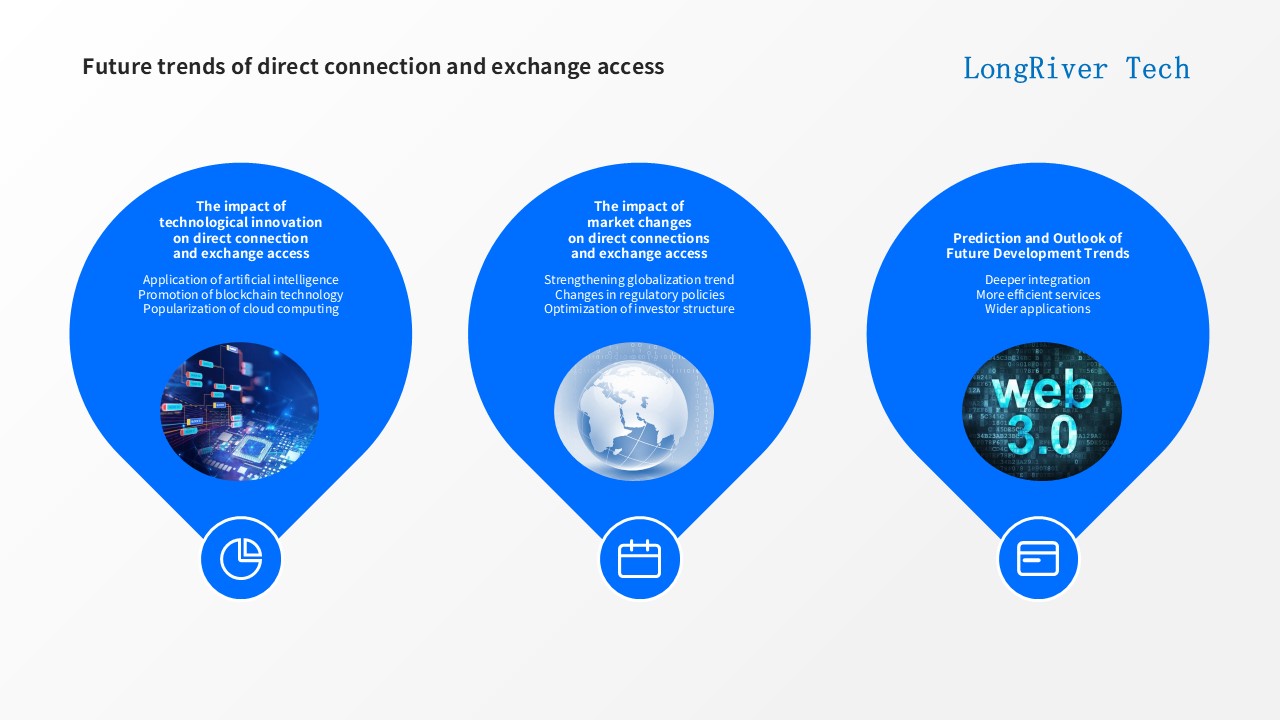

The impact of technological innovation on direct connection and exchange access includes: the application of artificial intelligence, the promotion of blockchain technology, and the popularization of cloud computing.

The impact of market changes on direct connection and exchange access includes: the strengthening of globalization trend, changes in regulatory policies, and optimization of investor structure.

The future development trends of direct connection and exchange access include: deeper integration, more efficient services, and wider applications.

Financial market direct connection and exchange access are one of the important directions of financial technology development. They have achieved efficient connection and information interaction in the financial market through technical means, and promoted the interconnection and business development of the financial market.