LongRiverTech Consulting: Fund Management System

A fund management system is an information system used to monitor, manage and optimize the inflow, outflow and use of corporate funds.

Different types of fund management have significant differences in objectives, strategies, risks and management requirements.

Corporate fund management focuses on turnover and value-added, financial institution fund management emphasizes security and liquidity,

government and regulatory agencies pay more attention to compliance and transparency, and international fund management requires comprehensive consideration of various complex factors of cross-border operations.

Common functions of fund management systems include: fund collection, fund transfer, fund inquiry, fund monitoring, fund analysis, data management, budget preparation and management, approval process management, system integration and report analysis, etc.

Fund management involves planning, acquiring, allocating and monitoring activities for organizational funds.

It is a key component of corporate operations,

ensuring the effective use of funds and minimizing risks.

Good fund management is essential to the survival and development of an enterprise.

The main goal of fund management is to maintain a balance between liquidity, profitability and risk control of funds.

Principles include budget compliance, effective management of cash flow, and reasonable assessment of risks.

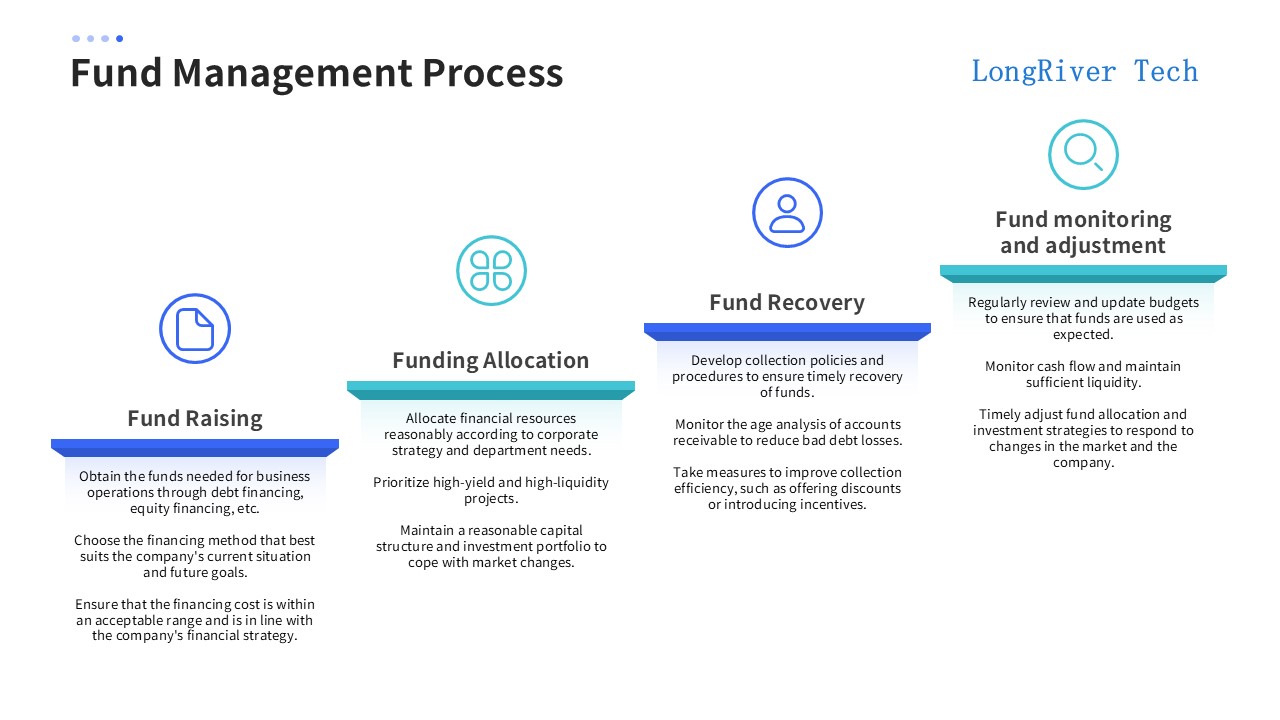

The complete process of fund management includes: fund raising, fund allocation, fund recovery, fund monitoring and adjustment.

In the fund raising stage, obtain the funds needed for business operations through debt financing, equity financing, etc.

Choose the financing method that best suits the current situation and future goals of the enterprise.

Ensure that the financing cost is within an acceptable range and in line with the company's financial strategy.

In the fund allocation stage, reasonably allocate fund resources according to the company's strategy and departmental needs.

Give priority to high-yield and high-liquidity projects.

Maintain a reasonable capital structure and investment portfolio to cope with market changes.

In the fund recovery stage, formulate collection policies and procedures to ensure timely recovery of funds.

Monitor the age analysis of accounts receivable to reduce bad debt losses.

Take measures to improve the efficiency of collection, such as providing discounts or introducing incentive mechanisms.

Enterprises need to review and update budgets regularly to ensure that the use of funds is in line with expectations.

Monitor cash flow and maintain sufficient working capital.

Timely adjust fund allocation and investment strategies to cope with changes in the market and the enterprise.

The tools and techniques that can be used for fund management include: budgeting, cash flow management, risk assessment and management, and investment decisions.

First, companies need to develop a comprehensive budget, including revenue, expenditure, investment, and financing plans.

Use methods such as zero-based budgeting to ensure the accuracy and flexibility of the budget.

Regularly review budget execution to ensure effective allocation of resources.

Companies need to timely and accurately forecast and manage cash inflows and outflows to maintain stable cash flow.

Maintain appropriate cash reserves to cope with emergencies.

Optimize cash utilization efficiency through short-term financing tools.

Risk assessment and management are crucial, and companies need to identify, evaluate, and monitor potential risks in fund management.

Establish risk response strategies, such as establishing risk reserves or insurance.

Conduct regular risk reviews to adapt to market changes.

Evaluate and select investment projects based on the company's long-term strategy.

Use indicators such as net present value and internal rate of return to evaluate the economic benefits of investment projects.

Ensure that investment decisions are in line with the company's risk tolerance and financial goals.

The purpose of corporate fund management is to accelerate capital turnover and achieve capital appreciation.

Enterprise capital management relies on capital budget and planning to ensure the demand for operating funds.

Enterprise capital management and material management are closely integrated and interdependent.

Enterprise capital management provides sufficient capital flow to maintain the stable operation of the enterprise.

Scientific and effective capital management is crucial to the stable operation of the enterprise.

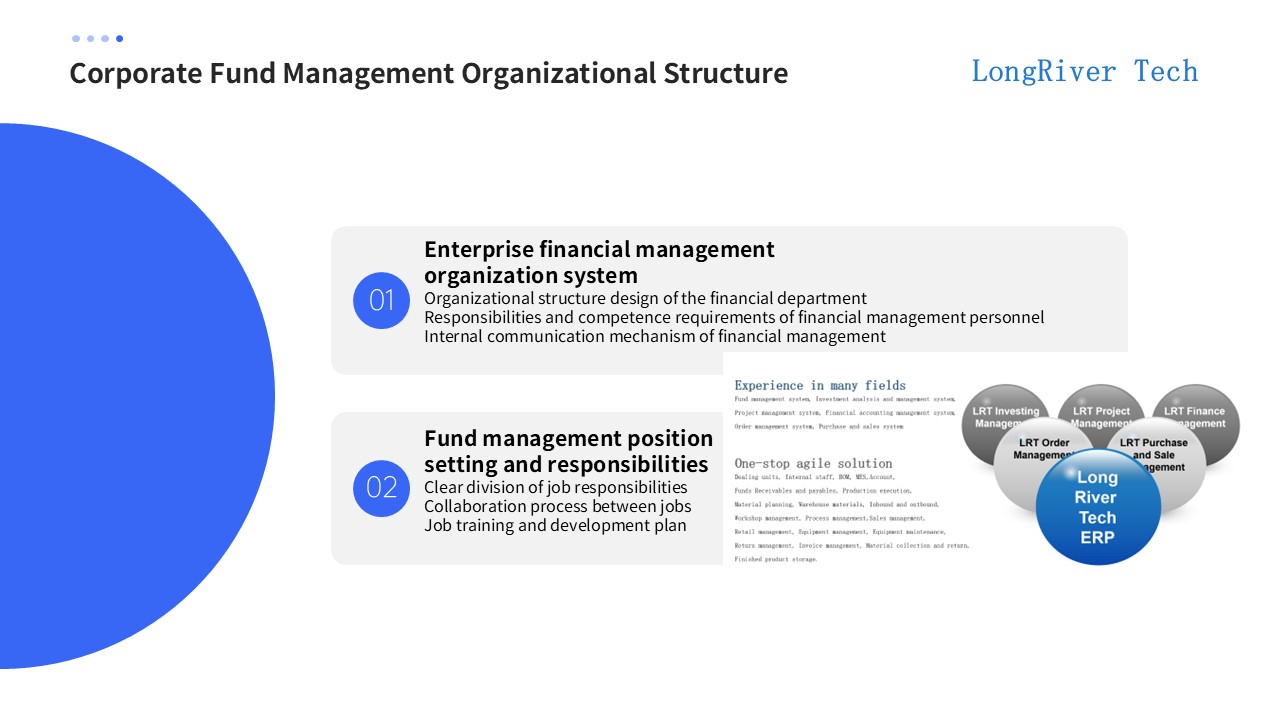

The enterprise financial management organizational system includes: the organizational structure design of the financial department, the responsibilities and ability requirements of financial management personnel, and the internal communication mechanism of financial management.

The requirements and content of the capital management position setting and responsibilities are: clear division of job responsibilities, collaboration process between positions, job training and development plan.

The enterprise capital management strategy system includes: long-term strategic planning of capital management, short-term capital allocation strategy, and maximization of the benefits of capital use.

When selecting and implementing capital management strategies, enterprises need to clarify the basis and evaluation methods of strategy selection, supervision and adjustment mechanisms during implementation, and effectiveness evaluation and feedback loops.

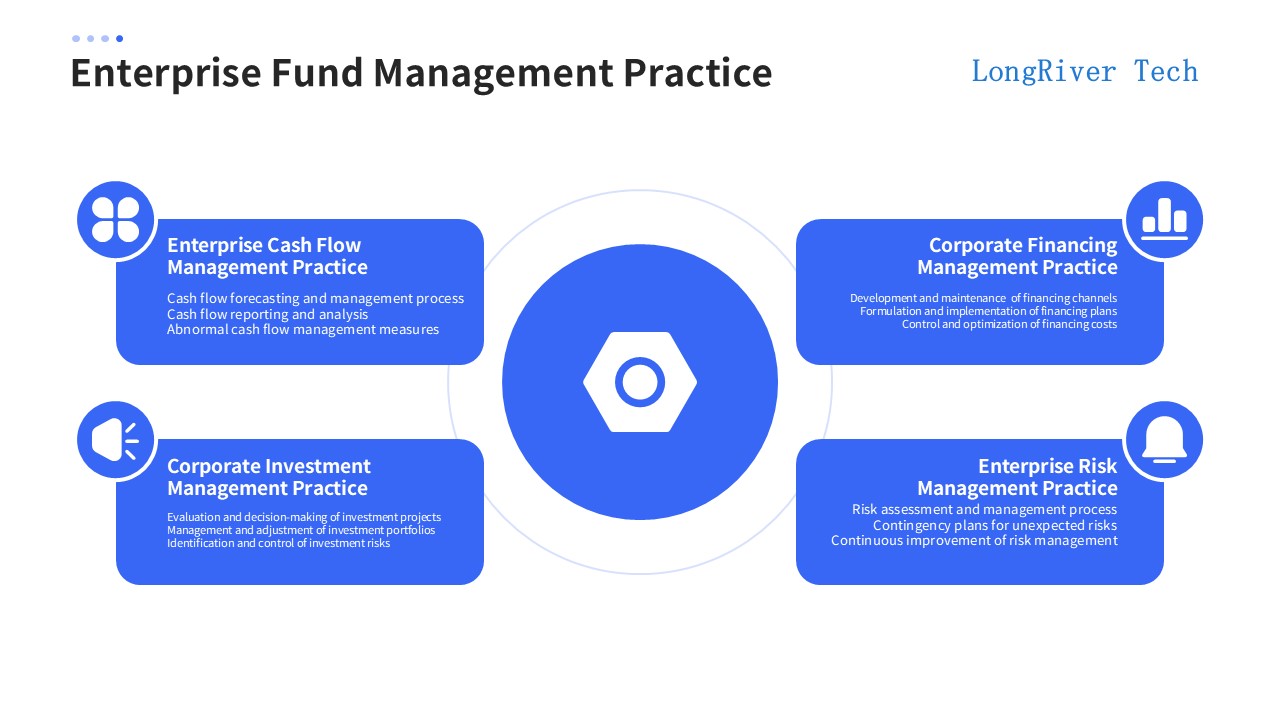

Enterprise cash flow management practices include: cash flow forecasting and management processes, cash flow reporting and analysis, and management measures for abnormal cash flow.

The practice of corporate financing management includes: the expansion and maintenance of financing channels, the formulation and implementation of financing plans, and the control and optimization of financing costs.

The practice of corporate investment management includes: the evaluation and decision-making of investment projects, the management and adjustment of investment portfolios, and the identification and control of investment risks.

The practice of corporate risk management includes: risk assessment and management processes, plans for dealing with unexpected risks, and continuous improvement of risk management.

Financial institution fund management usually adopts the "internal bank" management model and establishes a special fund operation department.

The scope of financial institution fund operation management is wide, including daily management of monetary funds, internal fund allocation, etc.

The uncertainty of financial institution fund operation efficiency is relatively large.

Compared with other fund management, financial institutions pay more attention to the security and liquidity of funds.

The fund management strategies of financial institutions are more complex and diverse.

Financial institutions need to meet the dual needs of fund liquidity and security.

Financial institutions face complex financial market environments and regulatory requirements.

Financial institutions involve large-scale fund operations and risk management.

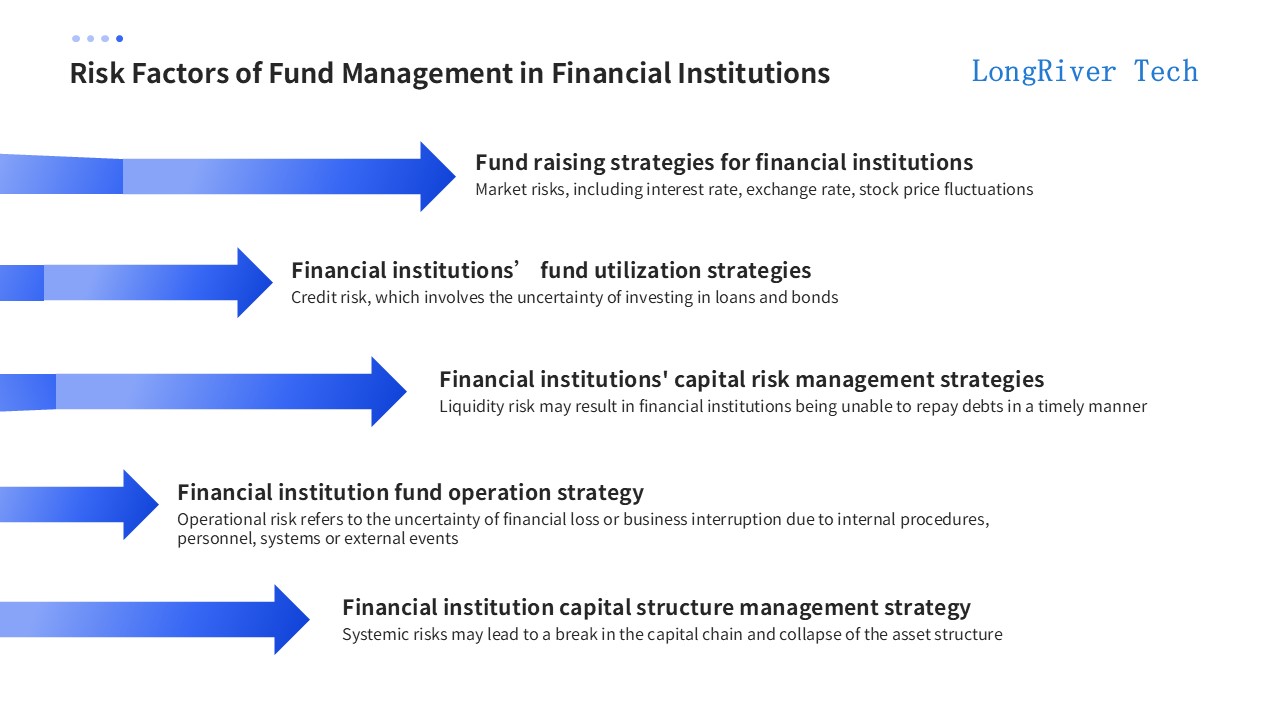

The risks of fund management of financial institutions mainly include: market risk, credit risk, liquidity risk, operational risk and systemic risk.

The fund raising strategy of financial institutions mainly considers market risk, including interest rate, exchange rate and stock price fluctuations.

The fund utilization strategy of financial institutions mainly considers credit risk, involving the uncertainty of loan and bond investment.

The fund risk management strategy of financial institutions mainly focuses on liquidity risk, which may cause financial institutions to fail to repay debts in time.

The fund operation strategy of financial institutions mainly considers operational risk, the uncertainty of fund loss or business interruption due to internal procedures, personnel, system or external events.

The fund structure management strategy of financial institutions mainly considers systemic risk, which may lead to the break of capital chain and collapse of asset structure.

The fund raising strategy of financial institutions mainly includes:

Absorbing public deposits and attracting deposits by providing interest.

Issuing bonds or stocks to raise external funds.

Using the interbank market to allocate funds.

The fund utilization strategy of financial institutions mainly includes:

Loan business, lending the raised funds to individuals or enterprises in need.

Investment business, purchasing stocks, bonds and other financial assets to obtain returns.

Asset management, achieving a balance between risk and return by allocating different asset categories.

The risk management strategies of financial institutions include:

Risk diversification, reducing risk concentration through diversified investment.

Risk hedging, using derivatives to manage risk exposure.

Capital adequacy management, ensuring sufficient capital to cope with potential losses.

Financial market tools of financial institutions include:

Certificates of deposit, short-term financing tools;

Bonds, debt instruments with long-term financing and fixed interest payments;

Foreign exchange futures, derivatives used to hedge foreign exchange risks.

Financial technology innovations of financial institutions include:

Blockchain technology, improving the transparency and security of transactions and clearing;

Artificial intelligence, optimizing asset allocation and risk prediction through algorithms;

Mobile payments, improving capital flow efficiency and customer experience.

Financial derivatives that financial institutions can use include:

Interest rate swaps, financial derivatives for managing interest rate risks;

Credit default swaps, insurance for credit risks;

Options, providing the right to buy or sell assets at a specific price at a specific time.

As the main body of project funding, the government has a dual identity.

Most investment projects are public projects with social benefits.

Fund management focuses on compliance and transparency.

Compared with other fund management, the government is more concerned and supervised by the public.

Specific laws and policies need to be followed.

The government financial management system is a complex and important system, which involves the division of various responsibilities, powers and interests of the state in organizing fiscal revenue and fiscal expenditure activities.

The government financial management system, referred to as the "fiscal system", is a fundamental system of national fiscal management and an important part of the national economic management system.

It mainly stipulates the responsibilities, powers, scope of fiscal revenue and expenditure, organizational principles, management methods and institutional settings of the central government and local governments at all levels, as well as the fiscal departments and other state organs, enterprises and institutions in fiscal management.

The government financial management system mainly includes the following four types:

(1) Budget management system: This is the core of the fiscal management system. It mainly divides the scope of budget revenue and expenditure and management authority at all levels according to the scope of responsibilities of the state governments at all levels, and stipulates the method of revenue and expenditure division.

(2) Tax management system: stipulates the duties and powers of government agencies at all levels in tax management, including a clear division of tax types and tax exemption rights, and specific provisions on the powers of tax collection and management.

(3) Administrative and public institution financial management system: stipulates the power and responsibility of state administrative agencies and public institutions to control funds in order to complete their work tasks and business plans, as well as the scope and management form of fund expenditure.

(4) Enterprise financial management system: stipulates the responsibilities, powers and interests between the state and enterprises and employees in fund management, cost management, enterprise income distribution and use during the reproduction process of state-owned enterprises.

The goal of government fund management is mainly to improve efficiency, promote social equity and maintain economic stability, while the management principles emphasize legality, economy, authenticity, unity, specificity and openness. These goals and principles together constitute the basic framework of government fund management.

Government budget management mainly includes: the process and method of budget preparation, monitoring and adjustment of budget execution, and evaluation and feedback of budget execution results.

Government investment management mainly includes: standards and methods for selecting government investment projects, implementation and management of government investment projects, and effect evaluation and risk control of government investment projects.

Government debt management needs to consider: types and characteristics of government debt, management principles and methods of government debt, and risk assessment and control of government debt.

Government cash flow management needs to consider: basic concepts and methods of cash flow management, processes and controls of cash flow management, and the impact of cash flow management on government fund management.

The role of fund regulatory agencies is to maintain the stability and healthy development of the financial market and protect the rights and interests of investors. Its responsibilities cover multiple aspects, from formulating regulatory policies to supervising financial institutions, warning of risks, combating illegal activities, and providing investor education.

The strategies and practices of fund regulatory agencies in fund management are diversified, including traditional means such as system construction, liquidity supervision, and information disclosure, as well as emerging fields such as risk management, cross-institutional cooperation, and technology applications.

These strategies and practices together constitute a comprehensive and multi-dimensional management framework for fund regulatory agencies.

International fund management involves cross-border fund raising, use, monitoring and dispatching, and is an important part of the international operation of enterprises.

International fund management is a complex and important task that requires enterprises to have professional knowledge and skills for effective management. Through reasonable strategies and practices and countermeasures to challenges, enterprises can achieve efficient management and risk control of international funds.

The international financial market refers to the market composed of international fund lending, settlement, exchange, and trading of securities, gold and foreign exchange.

The formation and development of this market relies on certain specific conditions, such as the concentration of financial institutions, loose foreign exchange and financial controls, low or no tax on securities trading, liberalization of gold trading, and convenient communication.

The international financial market is a market full of opportunities and challenges. By gaining in-depth information on its operating mechanism, participants and risk factors, we can better grasp market opportunities and avoid potential risks.

The international financial regulatory environment is a complex and changing field, which is affected by many factors.

The international financial regulatory environment is composed of multiple countries and international organizations, including financial regulatory agencies in various countries and international financial regulatory organizations such as the Basel Committee on Banking Supervision.

The development of financial technology has promoted regulatory agencies to adopt new technologies for supervision, such as artificial intelligence, big data analysis and blockchain, which are applied to risk assessment, market monitoring and other aspects.

The international financial regulatory environment is a field that is constantly developing and changing, and requires the joint efforts of regulators, financial institutions and investors to maintain the stability and healthy development of the international financial market.

International corporate fund management requires the comprehensive use of multi-currency fund management strategies, international cash flow management best practices, foreign exchange risk management and hedging strategies.

Fund management of international financial institutions needs to consider: asset-liability management principles, portfolio diversification strategies, and the construction and implementation of risk management systems.

Fund management of international governments and regulatory agencies needs to clarify the roles and functions of international financial institutions, strategies for maintaining global financial stability and promoting the progress of international financial regulatory sandbox experiments.

The international financial cooperation mechanism is a multi-level and multi-dimensional framework system aimed at promoting financial stability and economic growth among countries and responding to global financial challenges.

International financial organizations, such as the International Monetary Fund (IMF) and the World Bank, play a key role in global financial stability and development. They provide loans, technical assistance and policy advice to help member countries cope with financial crises and promote economic growth.

Multilateral cooperation institutions such as the G20 provide a platform for governments to discuss global financial issues and jointly respond to financial challenges through policy coordination and resource sharing.

Regional cooperation organizations such as the European Union and ASEAN have promoted closer financial cooperation and integration between countries with similar geographical proximity and economic backgrounds.

Bilateral cooperation countries deepen bilateral cooperation in the financial field by signing economic and trade agreements and currency swap agreements.

The development trend of fund management is moving towards digitalization, intelligence, blockchain and internationalization. These trends not only improve the efficiency and security of fund management, but also provide fund managers with more decision-making support and market opportunities.

Financial technology has been widely used in fund management, which can improve the efficiency of fund circulation, reduce transaction costs and enhance risk management capabilities.

The role of data analysis in fund management mainly includes: optimizing fund allocation strategies, predicting market trends and monitoring investment risks.

The trend of international financial regulatory policies is: strengthening cross-border fund supervision, promoting global financial regulatory coordination, and responding to money laundering and terrorist financing risks.

The development of domestic financial policies and regulations is mainly aimed at supporting the real economy, strengthening financial risk prevention and control, and promoting financial innovation.

The development opportunities and challenges of the fund management industry mainly include: transformation opportunities brought by financial technology, challenges of intensified market competition and the increasing importance of regulatory compliance.

The key factors of the future fund management industry are: technological innovation and application, changes in regulatory policies, market demand and investor behavior.

The fund management system provides a series of functions to help enterprises realize centralized management, monitoring and analysis of funds, thereby improving the efficiency and security of fund use and providing strong guarantees for the stable operation of enterprises.