LongRiverTech Consulting: Introduction to the functional modules of hedging management software

Hedging management software is a professional financial tool designed to help companies, investors and traders effectively manage risks arising from market price fluctuations.

Hedging management software helps companies manage risks, improve efficiency and reduce costs through functional modules such as real-time market monitoring, risk calculation and automated and semi-automated position adjustment transactions, so as to enhance the competitiveness and profitability of enterprises.

This software combines multiple functions such as market analysis, risk management, transaction execution and financial management to provide users with a one-stop solution.

The core goal of hedging management software is to help users lock in costs or benefits and reduce the negative impact of market fluctuations on business operations or personal investments. By monitoring market conditions in real time, the software can provide users with accurate market data and in-depth analysis, thereby assisting users in making more informed decisions.

In addition, the software also has powerful risk management functions, allowing users to set risk thresholds. Once market changes reach these thresholds, the system will issue an alarm in time to ensure that users can respond quickly. At the same time, the software also provides a variety of hedging strategies for users to choose from to minimize potential losses.

In terms of transaction execution, the software supports automated trading, which greatly improves transaction efficiency and accuracy. At the same time, it also provides comprehensive financial management tools to help users easily handle all financial matters related to hedging transactions.

The hedging management software supports the import of multiple data sources, automated data collection and update, and data quality detection and verification functions.

The hedging management software seamlessly integrates with the enterprise ERP system, real-time e-commerce trading platform and bank-enterprise direct connection system, receives or imports transaction production flow and bank fund flow in real time, and calculates risk exposure in a timely manner through preset credit limits and risk exposure limits.

The hedging management software automatically calculates the target position of the hedging tool based on risk exposure and hedging strategy, and calculates the appropriate increase, decrease, adjustment and transfer instructions based on the current position of the actual futures account, and the specific transaction execution is completed by the automatic transaction of the programmed trading program.

Achieve the expected hedging purpose with the lowest transaction cost, reduce risk exposure and control risks as much as possible.

The hedging strategy management module is the core part of the hedging management software, which aims to help users formulate, execute and monitor hedging strategies to manage market price volatility risks. This module provides users with a comprehensive hedging solution by integrating market analysis, risk management, transaction execution and other functions.

In hedging management software, the selection and access of data sources is a crucial link, which directly affects the operating efficiency and risk management effect of the software.

Data update and synchronization of hedging management software are crucial to ensure the accuracy and timeliness of risk management. Real-time updated data can help enterprises capture market dynamics in a timely manner, assess risks, and respond quickly.

In hedging management software, data quality monitoring and verification are important links to ensure the effective operation of the software and the accuracy of risk management decisions.

These measures help enterprises make more intelligent and accurate risk management decisions in a complex and changing market environment.

Hedging management software helps enterprises better identify, evaluate and manage risks by providing multi-dimensional analysis and evaluation functions, so as to make more informed decisions.

The main analysis and evaluation dimensions provided by hedging management software include market data analysis, transaction data analysis, risk identification and evaluation, hedging effect evaluation, portfolio analysis and stress testing, reporting and visualization tools:

These functions not only improve the risk management level of enterprises, but also provide strong support for the sound operation and sustainable development of enterprises.

In hedging management software, the definition and management of personalized strategies are an important part of the software functions.

Personalized strategy definition includes: custom strategy parameters, strategy template selection, strategy backtesting and verification.

Personalized strategy management includes: real-time strategy monitoring, strategy adjustment and optimization, strategy performance evaluation, risk warning and notification.

The personalized strategy definition and management function of hedging management software is designed to help users formulate and implement personalized hedging strategies according to their own needs and market conditions to minimize risks and maximize returns.

Through this function, users can respond to market changes more flexibly and improve risk management effects.

In hedging management software, risk indicator warning and control are important links to ensure that enterprises can respond to potential risks in a timely manner and ensure the safety of funds.

The risk indicator warning and control function of hedging management software is of great significance to ensure the safety of enterprise funds and respond to market fluctuations in a timely manner. Through real-time monitoring, personalized warning settings, automatic control measures, and regular risk reporting and analysis, enterprises can more effectively manage various risks in the hedging process.

The hedging operation execution module is an important part of the hedging management software. It realizes the specific operation of the hedging strategy and combines with the risk management module to provide users with a safe, flexible and efficient transaction execution environment.

The functions of the hedging operation execution module are: transaction execution, real-time monitoring and risk management.

The operation process of the hedging operation execution module mainly includes: strategy setting, transaction instruction issuance, transaction execution and monitoring, transaction settlement and reporting.

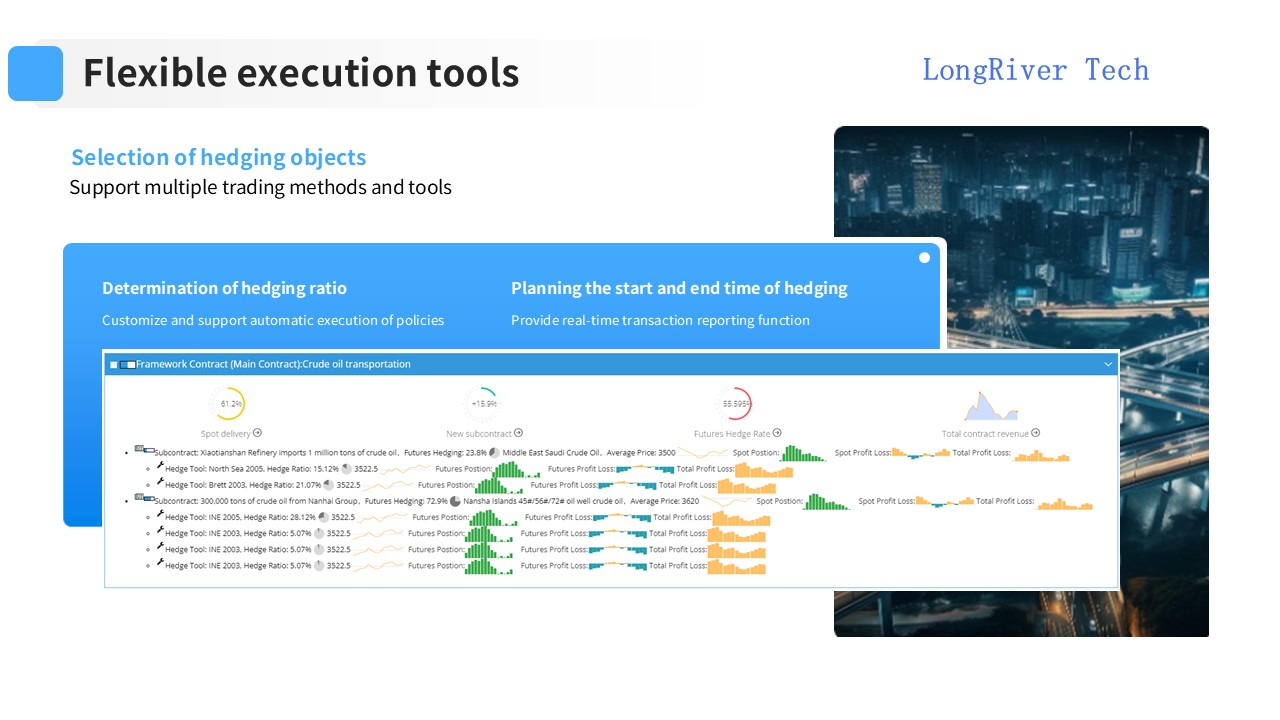

When selecting hedging objects, factors such as the correlation between futures contracts and spot, liquidity, matching of delivery months, costs, diversity of market participants and market depth should be comprehensively considered.

By comprehensively analyzing these factors, it is possible to more effectively formulate and implement hedging strategies, select appropriate trading methods and tools, determine hedging ratios, plan hedging start and end times, customize and automatically execute strategies, provide real-time transaction reports, and reduce risk exposure in the spot market.

The hedging analysis report module provides users with a comprehensive and in-depth analysis platform to help users better understand and evaluate the effects of hedging operations.

Through this module, users can clearly grasp the overall situation of hedging, deeply analyze the details of each transaction, evaluate the effect of risk management, and obtain market dynamics and market forecast information.

Simulation backtesting and risk analysis are crucial links in hedging management software. They not only help verify the effectiveness and performance of the software, but also help users better identify and manage potential risks. By making full use of these functions, enterprises can perform hedging operations more robustly and achieve asset preservation and appreciation.

Use historical market data to simulate transactions to test the performance of hedging transaction parameters under various market conditions.

Generate and issue hedging transaction instructions on the simulated exchange according to simulated transaction instructions, and conduct risk classification and early warning analysis.

Output transaction performance analysis and reports by performing statistical calculations on the monitoring and recording of hedging transaction execution.

Hedging management software plays an important role in market monitoring and market analysis. They not only provide real-time market data, but also conduct in-depth data analysis, provide trend forecasts and risk assessments, and even provide specific strategy recommendations. These functions greatly enhance the ability of enterprises to make wise decisions in the complex and changing futures market.

The selection and access of data sources for hedging management software is a complex and important link. By selecting reliable, diverse and compliant data sources, and establishing efficient data access and management systems through API interfaces, data cleaning and integration, and data storage and management technologies, strong support can be provided for the formulation and implementation of hedging strategies.

Hedging management software requires a professional team to ensure data security, data backup and recovery, technical support and maintenance of the data source.

Data update and synchronization of hedging management software include: regular update of market data, synchronization of data, ensuring data consistency, checking and correcting data errors or omissions.

Data quality monitoring includes: real-time monitoring of data sources, data integrity checks, data consistency verification and outlier detection.

Data quality verification includes: regular sampling checks, historical data backtesting, comparison with other data sources and user feedback mechanisms.

Through data quality monitoring and verification, the accuracy, integrity and consistency of data in hedging management software can be ensured, thereby improving the risk management effect and user experience of the software.

The collation and processing of historical market data is the basis, which includes: collation and cleaning of historical market data, processing of segmentation, adjustment and restoration of rights, etc., to ensure the accuracy and availability of historical market data.

The calculation and display of commonly used technical indicators are key. For example, the calculation of commonly used technical indicators, such as moving averages, relative strength indicators, etc., displays and analyzes the calculation results to help users understand market trends and assist users in making investment decisions based on the calculation results of technical indicators.

The calculation of hedging-related indicators is crucial. The calculation of hedging-related indicators, such as Delta, Gamma, etc., helps users analyze hedging strategies based on the calculation results of the indicators, provides hedging suggestions, and reduces market risks.

Market risk warning and alarm include: setting warning indicators and thresholds, real-time monitoring and generation of warning signals, and transmission and processing of warning information.

First, it is necessary to set the indicators and thresholds for market risk warnings, and flexibly adjust the warning conditions according to user needs to ensure the accuracy and adaptability of warning indicators.

The hedging management software background monitors market data in real time, triggers the generation of warning signals, evaluates the degree of market risk based on the intensity and duration of the warning signals, and generates warning signals in a timely manner to remind users to pay attention to market risks.

The hedging management software transmits the warning information to the relevant users or systems, and selects the appropriate delivery method, such as email or SMS, according to the user's needs, to assist the user in processing and making decisions on the warning information and reduce market risks.

The enterprise needs to clarify the goal of hedging, whether it is to avoid price risks, lock in costs or stabilize profits. This will determine the formulation and implementation of subsequent strategies.

The design of hedging strategies needs to comprehensively consider market conditions, enterprise needs and risk tolerance to formulate reasonable hedging strategies and strictly implement and manage them.

At the same time, enterprises need to keep a close eye on market dynamics and adjust strategies in time to cope with potential risks and challenges.

The formulation of hedging plans includes: selection of hedging objects, determination of hedging ratios, and planning of hedging start and end times.

The hedging management software provides a list of varieties in the account, and supports screening hedging objects based on account assets, historical transaction information and other factors.

The hedging management software monitors market conditions, updates optional hedging objects in real time, and provides comprehensive customized services.

The hedging management software supports manual addition and deletion of hedging objects to meet the needs of different users.

The hedging management software provides a variety of common hedging ratios to meet the needs of different users.

The hedging management software supports users to customize hedging ratios and optimize the risk-return of investment portfolios.

The hedging management software adaptively adjusts the hedging ratio according to market conditions to improve the effectiveness of the strategy.

The hedging management software provides a variety of common hedging scheme time planning to meet the needs of different users.

The hedging management software supports users to customize the start and end time of hedging to meet personalized needs.

The hedging management software adaptively adjusts the hedging time according to the hedging target to improve the effectiveness of the strategy.

The optimization and simulation of hedging strategies include: optimizing the parameter settings of hedging schemes, evaluating and analyzing the results of hedging simulations, and backtesting and verification based on historical data.

The hedging management software provides a variety of common hedging parameter settings to facilitate users to quickly optimize the scheme.

The hedging management software supports users to customize hedging parameters to improve personalized service experience.

The hedging management software adjusts hedging parameters based on historical data, market forecasts and other factors to improve the effectiveness of the strategy.

The hedging management software provides hedging simulation results and analyzes the optimization effect of the strategy.

The hedging management software supports hedging strategy risk assessment and provides users with comprehensive risk management services.

The hedging management software evaluates the effectiveness of hedging strategies based on historical data, market forecasts and other factors, and provides targeted suggestions.

The hedging management software provides historical data backtesting function to evaluate the historical performance of hedging strategies.

Hedging management software supports the verification and comparison of hedging strategies, and improves users' confidence in strategies.

Hedging management software analyzes the direction of strategy optimization based on the backtesting results of different investment portfolios and improves the effectiveness of strategies.

For the generation and signing of hedging contracts, hedging management software provides hedging contract generation tools, which comply with regulatory requirements, support users to customize hedging contract terms and formats, meet the needs of different users, and adaptively generate hedging contracts according to market conditions and user needs.

Hedging management software provides hedging plan publishing and management services, supports multiple publishing methods, supports subscription and push of hedging plans, facilitates users to obtain the latest strategies, and adaptively releases hedging strategies according to market conditions.

Hedging management software provides real-time monitoring and tracking services for hedging strategies, meets users' personalized management needs for investment risks, adjusts strategies in real time according to market conditions and user needs, improves strategy effectiveness, provides hedging strategy update services, and keeps services synchronized with the market.

The hedging management software provides comprehensive functional support in terms of transaction execution and recording, forming a complete workflow from issuing transaction instructions to saving transaction records to generating transaction reports. These functions help users to efficiently and accurately execute transactions and record relevant information, providing strong support for subsequent decision-making and analysis.

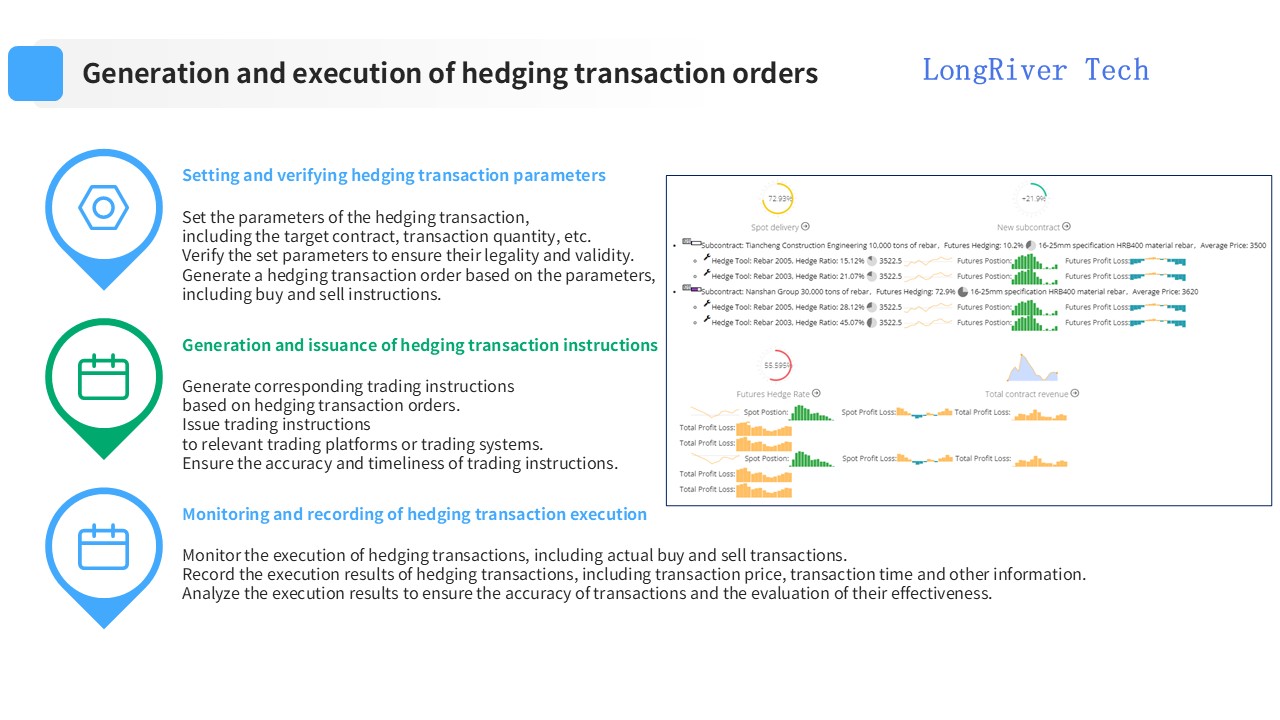

The setting and verification of hedging transaction parameters include: setting the parameters of hedging transactions, including target contracts, transaction quantities, etc. Verify the set parameters to ensure their legality and validity. Generate hedging transaction orders based on the parameters, including buy and sell instructions.

The generation and issuance of hedging transaction instructions include: generating corresponding transaction instructions based on hedging transaction orders, and issuing transaction instructions to relevant trading platforms or trading systems, ensuring the accuracy and timeliness of transaction instructions.

The monitoring and recording of hedging transaction execution includes: monitoring the execution of hedging transactions, including the actual transaction of buying and selling. Recording the execution results of hedging transactions, including transaction price, transaction time and other information. Analyzing the execution results to ensure the accuracy of transactions and the evaluation of effects.

Transaction cost and benefit calculation includes: cost calculation of hedging transactions, benefit evaluation of hedging transactions, risk control and cost optimization strategies.

Calculate the costs required for hedging transactions through hedging management software, including handling fees, interest, etc. Considering the factors of transaction costs, conduct cost evaluation of hedging transactions. Determine the overall cost of hedging transactions to provide a basis for risk control and benefit evaluation.

Evaluate the benefits of hedging transactions through hedging management software, including hedging effects, profit levels, etc. Compare the benefits and costs of hedging transactions to determine whether the expected goals are achieved. Analyze the reasons for changes in transaction benefits to provide reference for subsequent transaction decisions.

Set risk control strategies through hedging management software, including stop loss, stop profit and other rules. Optimize the cost of hedging transactions and find ways and strategies to reduce costs. Adjust risk control and cost optimization strategies according to different market conditions and transaction characteristics.

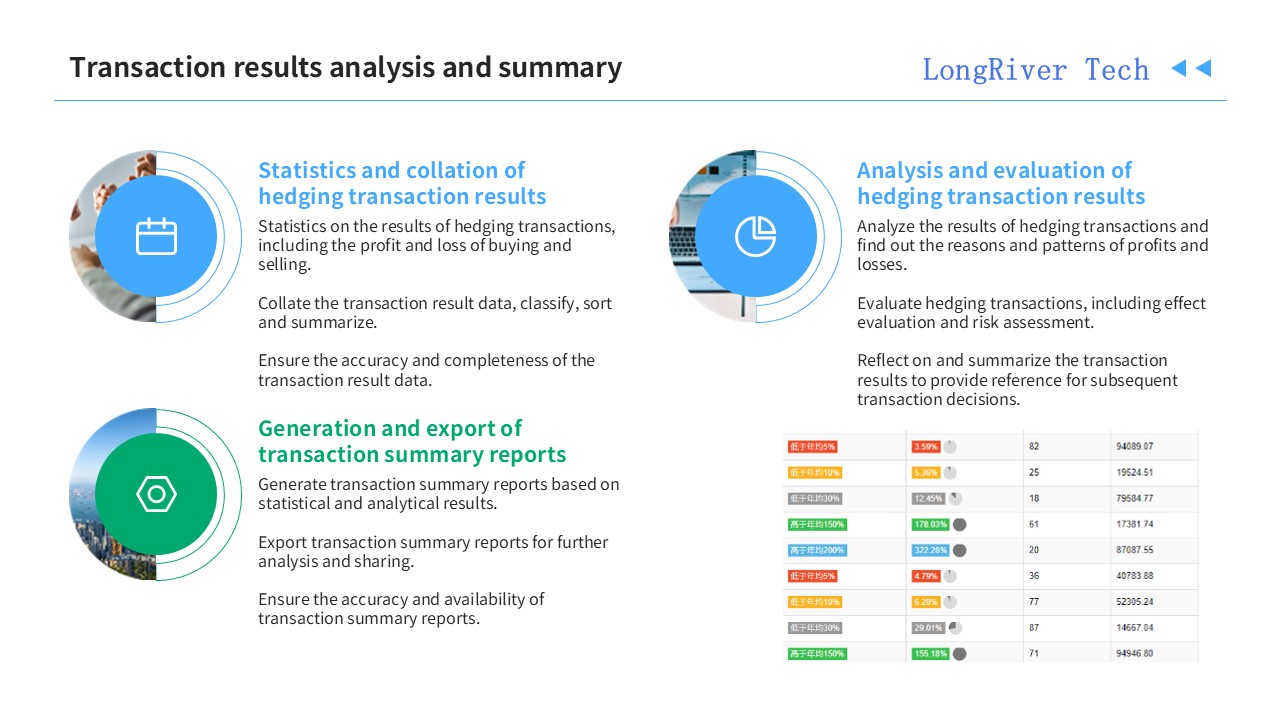

Through in-depth analysis and summary of transaction results by hedging management software, users can have a clearer understanding of the performance and risk status of hedging strategies. This provides strong data support for users to adjust strategies and optimize fund management.

Statistics and collation of hedging transaction results include: Statistics of hedging transaction results, including the profit and loss of buying and selling. Sorting out transaction result data, classifying, sorting and summarizing. Ensure the accuracy and completeness of transaction result data.

Analysis and evaluation of hedging transaction results include: Analyzing the results of hedging transactions and finding out the reasons and patterns of profit and loss. Evaluating hedging transactions, including effect evaluation and risk assessment. Reflecting on and summarizing transaction results to provide reference for subsequent transaction decisions.

The generation and export of transaction summary reports include: generating transaction summary reports based on statistical and analytical results. Exporting transaction summary reports for further analysis and sharing. Ensuring the accuracy and availability of transaction summary reports.

In general, hedging management software is an efficient and comprehensive risk management tool. Whether it is a large enterprise or an individual investor, it can be used to improve risk management and optimize trading strategies, thereby maintaining stable operations and investments in a complex and changing market environment.