LongRiverTech Consulting: Bank-enterprise direct payment management platform

The bank-enterprise direct payment management platform is an online management tool that directly connects with enterprises through the electronic banking system provided by the bank,

aiming to achieve convenient fund settlement, collection, inquiry, transfer and risk management functions, thereby improving the efficiency of enterprise fund use, reducing operational risks and financial costs.

The bank-enterprise direct payment management platform is an online management tool that enables enterprises to directly connect with the bank system through the online banking service provided by the bank.

This connection method is not limited to any means and can be carried out through the public network or dedicated line, ensuring that the enterprise can intervene at one point, so that all member units of the group can use this service.

The complete life cycle and considerations of the bank-enterprise direct payment management platform include: platform design and development, platform operation and management, regulatory compliance and risk management, innovation and development direction.

The bank-enterprise direct payment management platform usually provides a variety of functions to meet the needs of enterprises in fund management,

including: centralized fund management, fund collection, account inquiry, fund transfer, electronic bill management, financial statement generation and risk control.

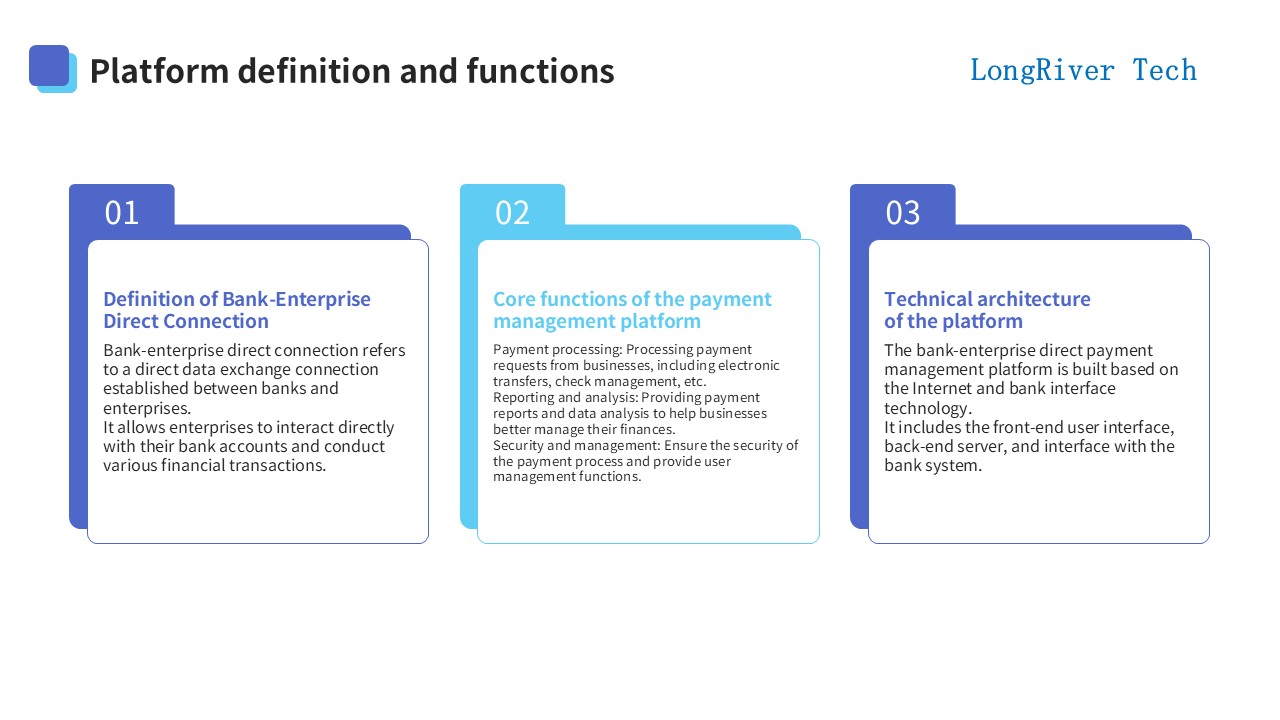

Bank-Enterprise Direct Connection refers to a direct data exchange connection established between banks and enterprises.

It allows enterprises to interact directly with their bank accounts and conduct various financial transactions.

The core functions of the payment management platform include: payment processing, reporting and analysis, security and management.

Payment processing mainly handles payment requests from enterprises, including electronic transfers, check management, etc.

Reporting and analysis provides payment reports and data analysis to help enterprises better manage their finances.

Security and management ensures the security of the payment process and provides user management functions.

The bank-enterprise direct connection payment management platform is built based on Internet and bank interface technology.

It includes a front-end user interface, a back-end server, and an interface with the bank system.

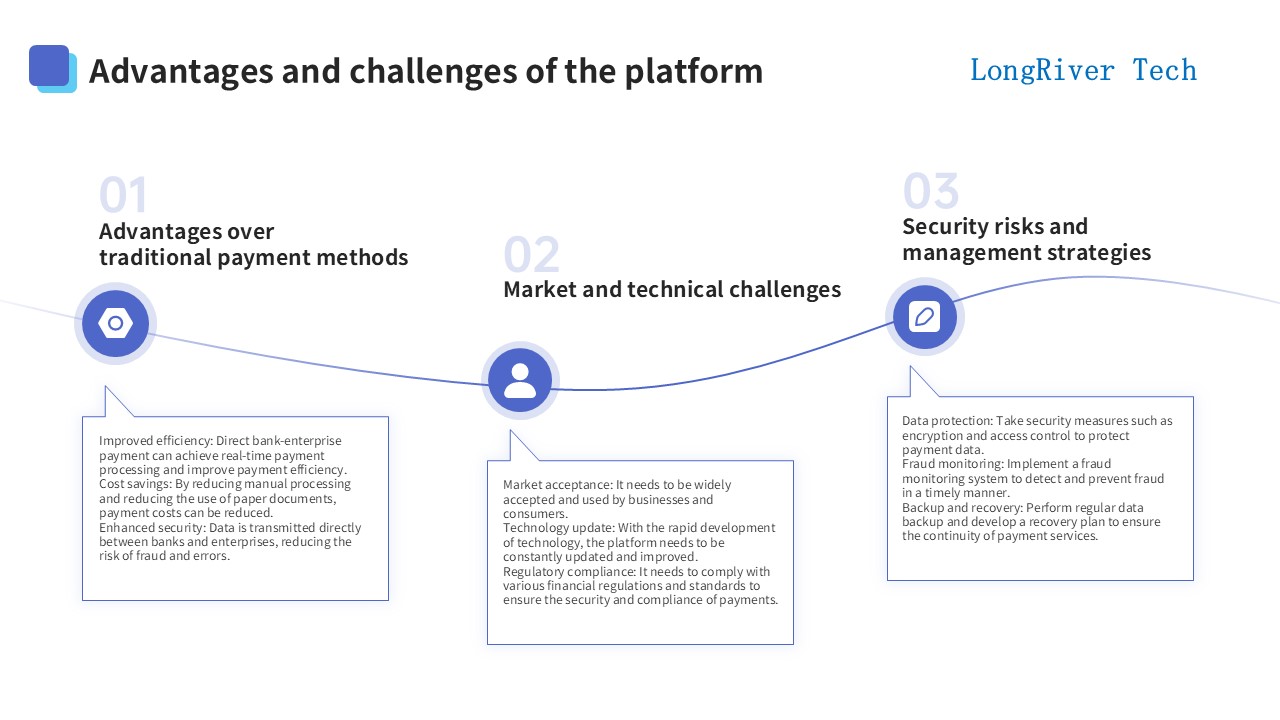

The advantages of the bank-enterprise direct connection payment management platform over traditional payment methods are:

(1) Improved efficiency: Bank-enterprise direct connection payment can achieve real-time payment processing and improve payment efficiency.

(2) Cost savings: By reducing manual processing and reducing the use of paper documents, payment costs can be reduced.

(3) Enhanced security: Data is transmitted directly between banks and enterprises, reducing the risk of fraud and errors.

The market and technical challenges faced by the bank-enterprise direct payment management platform are:

(1) Market acceptance: It needs to be widely accepted and used by enterprises and consumers.

(2) Technology update: With the rapid development of technology, the platform needs to be continuously updated and improved.

(3) Regulatory compliance: It needs to comply with various financial regulations and standards to ensure the security and compliance of payments.

The security risks and management strategies of the bank-enterprise direct payment management platform include:

(1) Data protection: Take security measures such as encryption and access control to protect payment data.

(2) Fraud monitoring: Implement a fraud monitoring system to detect and prevent fraud in a timely manner.

(3) Backup and recovery: Perform regular data backup and develop a recovery plan to ensure the continuity of payment services.

The bank-enterprise direct payment management platform is used in the retail industry to process a large number of transactions and improve payment efficiency and accuracy.

The bank-enterprise direct payment management platform is used in the manufacturing industry to make payments and collect payments with suppliers and customers.

The bank-enterprise direct payment management platform is used in the financial industry for internal transfers and customer payment processing.

Bank-enterprise direct payment has been widely used in China, and many large enterprises have adopted this technology.

In the international market, bank-enterprise direct payment technology has also been widely used, but there are some differences in language and regulations.

The future development trend of bank-enterprise direct payment management platform mainly has three major directions: mobile payment, blockchain technology and artificial intelligence.

With the popularization of mobile devices, mobile payment will become the mainstream payment method.

Blockchain technology may change the way payment is processed and provide more secure and reliable payment solutions.

Artificial intelligence will be used to automate payment processing and risk management.

The design and development of bank-enterprise direct payment management platform mainly involves the following aspects:

(1). Demand analysis and goal setting;

(2). System architecture design;

(3). Functional module development;

(4). Security and reliability design;

(5). Testing and optimization;

(6). Deployment and launch.

For the high availability and scalability of the system, the bank-enterprise direct payment management platform adopts a microservice architecture to ensure the high availability of the system,

introduces an automated scaling mechanism to cope with load changes, and implements hot backup and failover mechanisms to reduce downtime.

For data security and privacy protection, the bank-enterprise direct payment management platform deploys encryption algorithms to protect the security of data transmission,

implements strict access control policies to protect data privacy, and applies data desensitization technology to prevent sensitive information leakage.

Taking into account the user experience design principles, the bank-enterprise direct payment management platform is user-centric in design to ensure an intuitive and easy-to-use interface,

provides personalized setting options to meet the needs of different users, and introduces smart prompts and guided processes to reduce the difficulty of user operations.

The bank-enterprise direct payment management platform implements a clear and concise payment process interface. It integrates multiple payment methods to meet the needs of different users. It introduces a real-time payment status tracking and notification mechanism.

The bank-enterprise direct payment management platform deploys an advanced anti-fraud system to identify and prevent risks. Compliance checks are implemented to meet relevant regulatory requirements. Real-time transaction monitoring is introduced to ensure transaction security.

The bank-enterprise direct payment management platform has established a complete message notification mechanism to update the transaction status in time. Detailed logging functions are implemented to support auditing and troubleshooting. Log analysis tools are applied to optimize system performance.

The bank-enterprise direct payment management platform selects mainstream front-end and back-end frameworks to build applications, implements responsive design to support multi-terminal access, and adopts modular development to improve development efficiency.

The bank-enterprise direct payment management platform adopts a high-performance relational database management system, implements database sharding to improve query efficiency, and introduces a database cache mechanism to reduce read latency.

The bank-enterprise direct payment management platform defines standardized API interface specifications for system integration, implements interface load balancing and failover mechanisms, and introduces third-party service integration to expand platform functions.

The operation and management of the bank-enterprise direct payment management platform involves multiple key links,

such as: user training and support, fund settlement and circulation, data analysis and reporting,

system maintenance and upgrade, risk management and control, user management and permission setting, cooperative bank relationship management, security measures,

compliance with laws and regulations, protection of consumer rights, etc.

User registration and authentication mechanism, the bank-enterprise direct payment management platform supports multi-factor authentication to ensure user identity security.

Introduce automated review process to improve registration efficiency. Conduct security audits regularly to protect user data.

User role and permission allocation, the bank-enterprise direct payment management platform sets different roles according to user responsibilities to implement the principle of minimizing permissions.

Permission allocation is traceable to ensure compliance with compliance requirements. Provide dynamic permission adjustment function to meet business change needs.

User behavior analysis and optimization suggestions, the bank-enterprise direct payment management platform uses big data technology to analyze user behavior.

Provide personalized interface according to user usage patterns. Regularly push optimization suggestions to users to improve user experience.

Real-time monitoring of transaction data of the bank-enterprise direct payment management platform,

Deploy a real-time data monitoring system to ensure transaction security.

Establish an early warning mechanism to provide real-time prompts for abnormal transactions.

Support customized monitoring indicators to meet the needs of different scenarios.

Transaction data analysis and reporting of the bank-enterprise direct payment management platform,

Adopt advanced data analysis algorithms to provide in-depth transaction analysis.

Automatically generate transaction reports to facilitate managers to quickly grasp the situation.

Support customized reports to meet the needs of different management levels.

Anti-money laundering and anti-fraud strategies of the bank-enterprise direct payment management platform,

Establish a complete anti-money laundering system to prevent financial risks.

Adopt advanced fraud detection technology to protect payment security.

Conduct anti-money laundering and anti-fraud training regularly to improve employee awareness.

Establishment of customer service channels of the bank-enterprise direct payment management platform,

Provide multi-channel customer service, including telephone, email and online customer service.

Establish a unified customer service background to improve service efficiency.

Support international services to meet the needs of multilingual customers.

Customer problem handling and feedback mechanism of the bank-enterprise direct payment management platform,

Establish a standard problem handling process to ensure that problems are solved in a timely manner.

Introduce a customer feedback system to understand customer opinions in a timely manner.

Categorize customer feedback to ensure that problems are effectively handled.

Customer satisfaction survey and improvement measures of the bank-enterprise direct payment management platform,

Conduct customer satisfaction surveys regularly to understand the real feelings of customers.

Develop specific measures to improve customer satisfaction based on the survey results.

Establish a continuous improvement mechanism to continuously improve service quality.

Regulatory compliance of the bank-enterprise direct payment management platform includes: payment and settlement related regulations, online payment business compliance, data protection and privacy security, anti-money laundering and anti-terrorist financing obligations.

Risk management of the bank-enterprise direct payment management platform includes: technical security, capital risk management, operational risk management, compliance risk management, emergency plans and crisis management.

The laws and regulations of the payment industry are formulated to protect consumer rights and ensure the security of financial transactions.

These laws and regulations include but are not limited to anti-money laundering regulations, consumer protection laws, bank secrecy laws, etc.

Compliance with these laws and regulations is the basis for the operation of payment platforms and the key to protecting the rights and interests of platforms and consumers.

The bank-enterprise direct payment management platform needs to establish a compliance system, including formulating internal compliance policies and processes and conducting regular compliance training.

The bank-enterprise direct payment management platform needs to maintain good communication with regulators and keep abreast of the latest regulatory requirements.

The bank-enterprise direct payment management platform needs to conduct internal audits regularly to ensure the effective operation of the compliance system.

The update of regulations is normal, and the bank-enterprise direct payment management platform needs to establish a mechanism to obtain and interpret new regulations in a timely manner.

The bank-enterprise direct payment management platform needs to evaluate new regulatory requirements and determine their impact on platform operations.

The bank-enterprise direct payment management platform needs to develop a response strategy, including adjusting business processes and systems to ensure continuous compliance.

The main risks faced by the bank-enterprise direct payment management platform include transaction risks, compliance risks, technical risks, etc.

These risks may come from changes in the external environment or from management issues within the platform.

Identifying and assessing these risks is the first step in platform risk management.

Risk assessment methods include qualitative assessment and quantitative assessment.

Qualitative assessment is to assess risk through expert opinions and empirical judgment.

Quantitative assessment is to quantify risk using statistical data and models.

The response measures for risk events include risk prevention, risk transfer and risk bearing.

Risk prevention is to prevent the occurrence of risks through internal control and risk management processes.

Risk transfer is to transfer risks by purchasing insurance or signing contracts with other parties.

The innovation and development direction of the bank-enterprise direct payment management platform includes:

Codeless integration and intelligent configuration, enhanced data analysis and visualization functions, continuous improvement of security and risk control,

mobility and multi-terminal support, expansion of financial services and value-added functions, open API and ecosystem construction, personalized services and support.

The application of blockchain technology in payment can improve transaction transparency and security, reduce transaction costs and improve efficiency, and realize decentralized payment processing.

The application of artificial intelligence in risk management can monitor transactions in real time and conduct risk assessment, automatically identify fraud and prevent risks, and improve decision-making efficiency and accuracy.

The integrated application of cloud computing and big data technology can improve data processing and storage capabilities, realize personalized payment experience, optimize payment processes and reduce costs.

The combination of bank-enterprise direct payment and other financial services can realize a one-stop financial service experience, broaden the scope of services and increase user stickiness, and innovate financial products and services.

The formulation and implementation of the open platform strategy of the bank-enterprise direct payment management platform can attract more partners to join, share resources and achieve win-win results, and improve market influence and competitiveness.

Partner selection and relationship management are crucial. Select partners that are consistent with strategic goals, establish long-term and stable cooperative relationships, and achieve complementary advantages and common development.

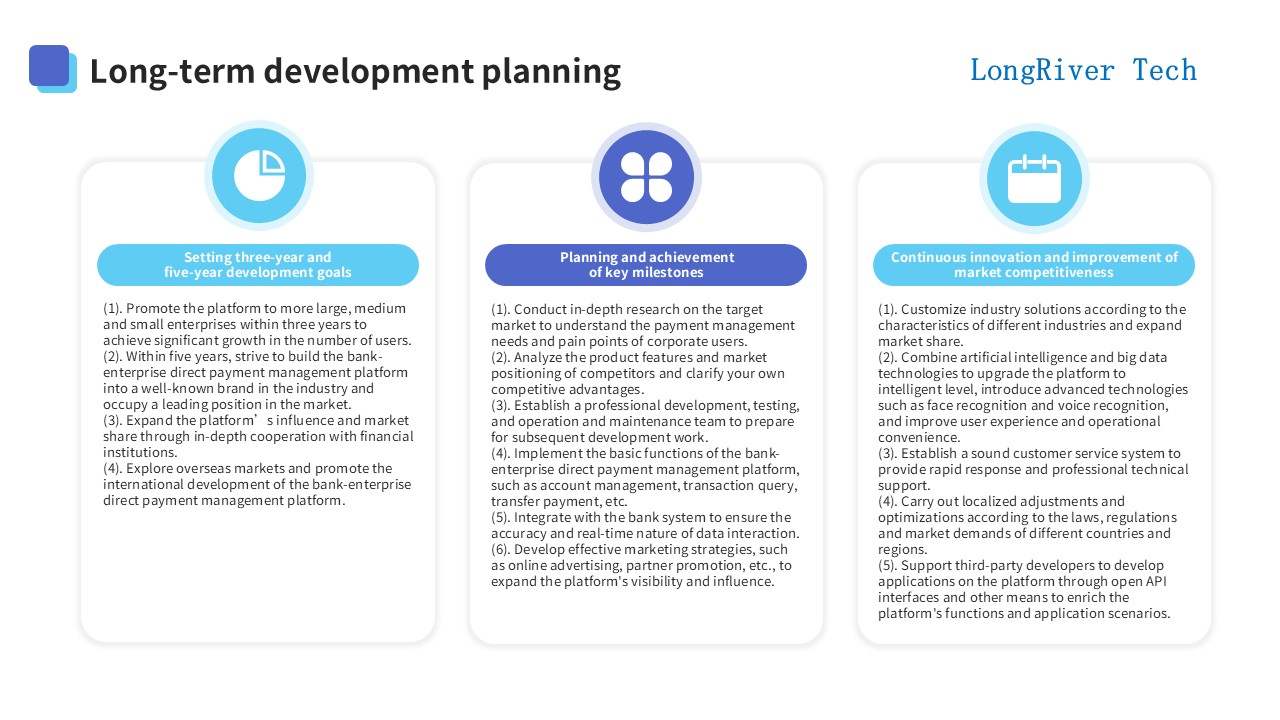

The three-year and five-year development goals of the bank-enterprise direct payment management platform are:

(1). Promote the platform to more large, medium and small enterprises within three years and achieve a significant increase in the number of users.

(2). Within five years, strive to build the bank-enterprise direct payment management platform into a well-known brand in the industry and occupy a leading position in the market.

(3). Expand the platform's influence and market share through in-depth cooperation with financial institutions.

(4). Explore overseas markets and promote the international development of the bank-enterprise direct payment management platform.

The planning and implementation of key milestones of the bank-enterprise direct payment management platform include:

(1). Conduct in-depth research on the target market to understand the payment management needs and pain points of corporate users.

(2). Analyze the product characteristics and market positioning of competitors and clarify their own competitive advantages.

(3). Establish a professional development, testing, and operation and maintenance team to prepare for subsequent development work.

(4). Implement the basic functions of the bank-enterprise direct payment management platform, such as account management, transaction query, transfer payment, etc.

(5). Integrate with the bank system to ensure the accuracy and real-time nature of data interaction.

(6). Formulate effective marketing strategies, such as online advertising and partner promotion, to expand the platform's visibility and influence.

The continuous innovation and market competitiveness improvement of the bank-enterprise direct payment management platform specifically include:

(1). Customize industry solutions based on the characteristics of different industries to expand market share.

(2). Combine artificial intelligence and big data technologies to upgrade the platform to intelligent, introduce advanced technologies such as face recognition and voice recognition, and improve user experience and operational convenience.

(3). Establish a sound customer service system to provide quick response and professional technical support.

(4). Carry out localized adjustments and optimizations based on the laws, regulations and market demands of different countries and regions.

(5). Support third-party developers to develop applications on the platform through open API interfaces and other means to enrich the platform's functions and application scenarios.

The bank-enterprise direct payment management platform is an efficient and secure enterprise-bank connection solution, helping enterprises to achieve digitalization and automation of fund management.

In summary, the bank-enterprise direct payment management platform is a powerful tool for modern enterprise financial management. By achieving seamless connection between banks and enterprise systems, it greatly improves the efficiency and security of enterprises in fund management.