LongRiverTech Consulting: Roadmap for building a treasury management system

The treasury management system construction roadmap can be summarized as: starting from the formulation of treasury management strategic planning, through optimizing processes, building systems, and integrating resources, ultimately achieving efficient and transparent treasury operations and risk control.

The treasury management system construction roadmap can be roughly divided into the following steps:

Step 1: Demand analysis and planning;

Step 2: Process optimization and design;

Step 3: System selection and construction;

Step 4: Resource integration and configuration;

Step 5: Risk management and control;

Step 6: Training and launch;

Step 7: Continuous improvement and upgrading.

This roadmap is a rough framework, and the specific implementation process may need to be adjusted according to the actual situation of the enterprise. At the same time, the construction of the treasury management system is a continuous process, which requires enterprises to continuously monitor, evaluate and improve to ensure the continued effectiveness and adaptability of the system.

The construction of the treasury management system is a systematic project carried out by enterprises to improve financial management efficiency, optimize capital operations, and strengthen risk control. The construction of this system aims to integrate the financial and capital resources of the enterprise, and to achieve comprehensive, accurate and efficient management of the enterprise's treasury by formulating scientific management systems, optimizing management processes, and introducing advanced information technology tools.

In the construction of the treasury management system, enterprises need to focus on several core aspects: first, capital management, including the raising, use, dispatching and monitoring of funds, to ensure the security and liquidity of the enterprise's funds; second, the optimization of financial management processes, by simplifying and standardizing processes, to improve the transparency and efficiency of financial management; third, the construction of information systems, using modern information technology to achieve digitalization and intelligence of financial management, and improve the scientificity and timeliness of management decisions; finally, the strengthening of risk control, by improving internal control mechanisms, establishing risk assessment and early warning systems, effectively preventing and responding to financial risks.

The construction of the treasury management system is of great significance to the development of enterprises. It can not only help enterprises better grasp their own financial status and capital flow, provide strong support for the strategic decision-making of enterprises, but also enhance the market competitiveness of enterprises and achieve sustainable development. Therefore, enterprises should attach great importance to the construction of the treasury management system, continuously optimize and improve relevant systems and processes, and ensure that the treasury management system can fully play its due role.

Treasury management is the centralized management of corporate funds, achieving efficient operation and risk control of funds, and ensuring the balance between corporate liquidity and profitability.

Treasury management refers to the comprehensive and systematic management and optimization of a company's own funds and financial resources. It covers the raising, use, scheduling, risk control and related financial management activities of funds, aiming to ensure the safety, liquidity and value-added of corporate funds, while supporting the company's strategic goals and daily operations.

The construction of a treasury management system first needs to establish goals, such as:

Establish a comprehensive and efficient fund management system,

Improve the efficiency of fund use, reduce costs,

Enhance the company's financial risk resistance.

The company also needs to follow the principles of system construction:

Overall planning, step-by-step implementation;

Combined with reality, focus on effectiveness;

Continuous improvement and continuous improvement.

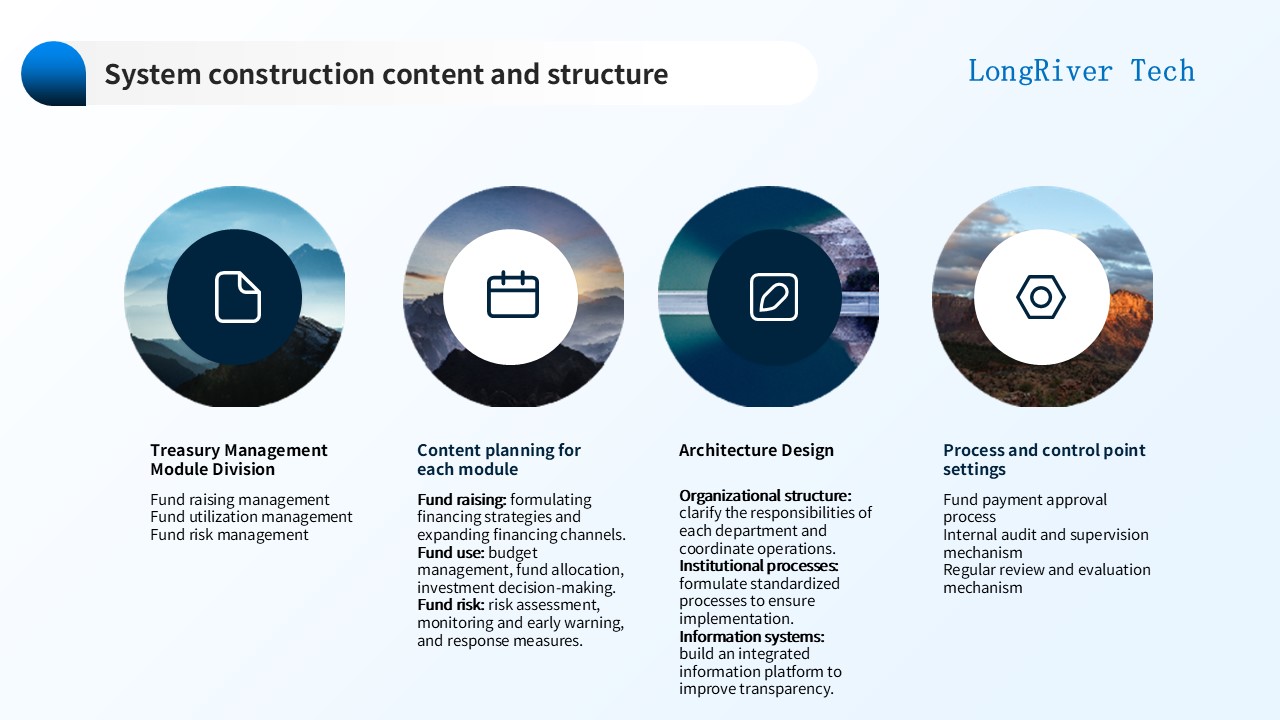

Treasury management can be divided into modules: fund raising management, fund use management and fund risk management.

The main contents of fund raising include: financing strategy formulation and financing channel expansion.

Fund use includes: budget management, fund allocation, and investment decision-making.

Fund risk management includes: risk assessment, monitoring and early warning, and response measures.

Treasury management system structure design includes:

Organizational structure design: clarify the responsibilities of each department and operate in coordination.

System process implementation: formulate standardized processes to ensure execution.

Information system implementation: build an integrated information platform to improve transparency.

Treasury management processes and control points are set up: fund payment approval process, internal audit and supervision mechanism, regular review and evaluation mechanism.

The implementation steps of the treasury management system are: design and development, implementation and operation, inspection and evaluation.

In the preparation stage of treasury management system construction, the implementation plan needs to be formulated first.

Investigate the existing treasury management situation, determine the goals and content of system construction, and prepare an implementation plan.

Then it is necessary to organize training and publicity, including: designing training plans and courses, carrying out training and publicity activities, and improving the awareness of treasury management among all employees.

At the same time, it is also necessary to prepare resources and tools, determine the required resources and tools, configure relevant hardware and software, and ensure that resources are sufficient and ready.

In the design and development stage of the treasury management system construction, it is necessary to design the management system framework first.

For example, analyze the organizational structure and business processes, design the overall architecture of the management system, and establish the key elements of the management system.

Then it is necessary to develop management processes and systems, including: sorting out existing management processes and systems, designing and developing new management processes, and formulating relevant management rules and regulations.

Finally, it is necessary to formulate operation manuals and instructions, sort out operation processes and steps, write detailed operation manuals, and formulate management instructions for reference.

After the treasury management system construction enters the implementation stage, it is deployed according to the implementation plan to ensure the smooth progress of each link, and timely adjust and optimize the implementation process.

After the treasury management system construction is put into operation, it is necessary to ensure the implementation of various systems of the management system, supervise and inspect the implementation, and ensure the effective operation of the management system.

The performance monitoring management of the treasury management system construction includes: establishing performance evaluation indicators and methods, regularly collecting and analyzing data, and evaluating the performance of the management system.

The construction of the treasury management system also requires continuous improvement and optimization, identifying existing problems and deficiencies, analyzing the causes and formulating improvement measures, and continuously optimizing the management system.

The inspection and evaluation stage of the treasury management system construction includes: conducting internal audits, conducting management reviews, evaluating the results of system construction, and making improvement suggestions.

Conducting internal audits includes: formulating audit plans and procedures, implementing internal audit work, and proposing audit reports and improvement suggestions.

Conducting management reviews includes: arranging management review meetings, evaluating the suitability of the management system, and determining improvement directions and priorities.

Evaluating the results of system construction includes: comprehensively evaluating the results of system construction, analyzing the situation of achieving goals and plans, and summarizing the lessons learned from system construction.

Proposing improvement suggestions includes: analyzing existing problems and deficiencies, proposing targeted improvement suggestions, and formulating subsequent improvement and optimization plans.

The key factors for the successful construction of the treasury management system are: organizational and cultural factors, human resource factors, and technical factors.

Organizational and cultural factors include: clear organizational structure and responsibilities, integration of corporate culture and system construction, and establishment of incentive and punishment mechanisms.

First of all, the organizational structure and responsibilities need to be clear, and the responsibilities of each department need to be clarified to ensure that all work is carried out in an orderly manner.

Set up a special team to be responsible for system construction to ensure effective allocation of resources.

Develop a detailed system construction plan and timetable.

Secondly, corporate culture should be integrated with system construction, and system construction should be incorporated into corporate culture to enhance employees' sense of identity and participation.

Organize training regularly to strengthen the role of corporate culture in system construction.

Encourage employees to put forward improvement suggestions to form a positive corporate improvement atmosphere.

Establishing an incentive and punishment mechanism is also an important factor for the smooth implementation of treasury management system construction.

Establish clear reward and punishment standards to ensure the achievement of system construction goals.

Reward teams and individuals with outstanding performance to stimulate work enthusiasm.

Impose necessary penalties for failure to perform duties or hinder system construction.

Human resource factors for treasury management system construction include: training and talent reserves, teamwork and communication, and personnel capabilities and quality requirements.

For training and talent reserve, enterprises need to conduct regular training related to treasury management to improve the professional ability of employees. Establish a talent reserve mechanism to provide talent guarantee for system construction. Encourage employees to participate in external training and certificate examinations to broaden their knowledge.

For team collaboration and communication, enterprises need to establish an efficient team collaboration mechanism to ensure the smooth progress of system construction. Organize team communication regularly to improve team collaboration efficiency. Use modern communication tools to improve the quality of team communication.

For personnel ability and quality requirements, enterprises need to formulate detailed ability and quality standards to ensure that team members have the necessary professional capabilities. Optimize the team personnel structure through internal promotion and external recruitment. Strengthen the performance management system to improve the work efficiency and quality of personnel.

The technical factors for the construction of treasury management system include: information technology support, data analysis and reporting, automation and intelligent applications.

For information technology support, enterprises need to adopt advanced information technology to improve the efficiency and security of treasury management system. Regularly upgrade and optimize the information system to meet the needs of business development. Establish an IT support team to ensure the stable operation of the information system.

For data analysis and reporting, enterprises need to establish a data analysis mechanism to conduct in-depth analysis of financial data on a regular basis. Develop standardized report templates to ensure the accuracy and consistency of reports. Provide analysis reports to senior management on a regular basis to support decision-making.

For automation and intelligent applications, enterprises need to promote the automation of financial processes, reduce manual intervention, and improve work efficiency. Explore intelligent applications, such as AI-assisted decision-making, to improve the level of intelligent financial management. Establish a continuous improvement mechanism for automation and intelligent applications.

The construction of the treasury management system will also encounter many challenges, such as: changes in the internal and external environment, problems in the system construction process, and the maintenance and improvement of the results of the system construction.

The challenges of coping with changes in the internal and external environment include: coping with changes in policies and regulations, coping with market and corporate strategy adjustments, and coping with technological progress and innovation.

Coping with changes in policies and regulations requires regular monitoring of policy and regulatory updates, compliance self-assessment, and the establishment of a compliance training mechanism.

Strategies for coping with market and corporate strategic adjustments include: analyzing market trends and their impact on the company, adjusting strategic planning to adapt to market changes, and establishing a flexible strategic implementation mechanism.

In response to technological progress and innovation, companies need to track the latest developments in financial technology, explore the application of technology in treasury management, and promote the implementation of innovative projects.

Problems will inevitably arise during the construction of the treasury management system. Companies need to solve these problems and prepare countermeasures, such as: establishing a problem feedback and resolution mechanism, adopting project management methodology and conducting regular risk assessments.

At the same time, companies need to prevent the occurrence of potential problems, formulate preventive control measures, enhance the internal control environment, and enhance employees' risk awareness.

For problems with system construction itself, companies need to make timely adjustments and corrections, implement continuous monitoring and reporting mechanisms, establish change management processes, and regularly review and update system documents.

The sustainability of treasury management system construction needs to be guaranteed from multiple aspects: continuous improvement of system construction, improvement of management system performance, and maintenance of system construction momentum.

Continuous improvement of system construction includes: setting improvement goals and plans, encouraging employees to put forward improvement suggestions, and tracking the application of improvement results.

Improving management system performance includes: establishing performance indicators and assessment mechanisms, implementing regular management system reviews, and promoting cross-departmental collaboration and communication.

Maintaining the motivation for system construction includes: organizing system and construction training and exchanges, rewarding system and construction contributors, and maintaining a positive cultural construction.

The construction of treasury management system has achieved different results in different companies. Through the implementation of research planning, organizational structure optimization, system process improvement, information system construction, and personnel training and assessment, some companies have successfully built an efficient and standardized treasury management system. This not only improves the company's financial management level and investment decision-making efficiency, but also lays a solid foundation for the long-term development of the company.

A large multinational group company, with the continuous expansion of its business, has a large number of multi-currency account funds dispersed, decision-making efficiency is low, and multiple risk events are exposed and cause significant losses. That is, there is a large amount of idle funds lying in the account and investing in inappropriate financial products and financial derivatives instruments, causing losses. Some subsidiaries are facing a shortage of funds that seriously affects the operation of the main business and adopt inappropriate financing methods, which in turn affects the implementation and execution of the strategy. The original financial management system can no longer meet the needs of corporate development. In order to improve financial management efficiency and risk control capabilities, the company decided to build a comprehensive treasury management system.

The group company set up a special project team to conduct research and demand analysis, and formulate and implement plans.

The company first conducted a comprehensive survey of the current status of financial management to identify the main problems and improvement directions. On this basis, a detailed treasury management system construction plan was formulated, and the construction goals, implementation paths and timetables were clarified.

The company adjusted the treasury management organizational structure and established a special treasury management department to be responsible for the fundraising, use and monitoring of the entire group. At the same time, the responsibilities and powers of financial management personnel at all levels are clarified to ensure the smooth development of treasury management.

The company has formulated a series of treasury management systems and processes, including capital budgeting, revenue and expenditure management, accounting management, risk management, hedging management and investment management. These systems and processes not only standardize financial management behavior, but also improve decision-making efficiency and the effectiveness of capital use.

The company has introduced an advanced treasury management information system to achieve real-time collection, analysis and reporting of treasury management data. Through the information system, the company can monitor the flow of funds in real time and promptly discover and solve potential problems.

The company regularly conducts professional training for treasury management personnel to improve their professional quality and business capabilities. At the same time, a complete assessment mechanism has been established to objectively evaluate the work performance of financial management personnel and encourage them to continuously improve their capabilities.

After a period of treasury management system construction, the company has achieved remarkable results, improved the efficiency of capital use, reduced financial risks, and improved the quality of financial services.

The success of the group company's treasury management system construction is mainly due to clear goals and principles, full participation and continuous improvement, and strengthening leadership and execution.

A large traditional manufacturing company, with multiple subsidiaries and factories, has chaotic financial management. It often does not know how much cash, liabilities, accounts receivable and payable, assets, and investments the group has in total. There are often sudden requests for payment from suppliers, and a large amount of sales funds that have been advanced cannot be recovered. After hasty selection and implementation, a set of treasury management systems from foreign counterparts were copied, and secondary development and transformation were done on the basis of a set of financial management software to be used as a treasury management information system.

In the end, the construction of the treasury management system failed, the company's capital management efficiency dropped significantly, and the flow of funds was often stuck in various approval links. The capital flow was not smooth, and there was often a shortage or idleness of funds. The failed treasury management system could not provide accurate and timely financial data and information support to the management, resulting in frequent decision-making errors. The failure of the treasury management system construction made employees doubt the development prospects of the company and their morale was low. Some excellent employees chose to leave because of their disappointment with the company's management, resulting in talent loss.

When enterprises are building a treasury management system, they lack in-depth understanding and analysis, unreasonable implementation plans, and insufficient resources and support.

Lack of effective risk management, wrong information system selection, neglect of employee participation and feedback, and insufficient execution.

When enterprises are building a treasury management system, they need to fully prepare and investigate, reasonably plan and implement in stages, and continuously monitor and adjust.

Tailor-made planning plans, carefully select information systems, strengthen personnel training and knowledge updates, and strengthen internal communication and collaboration.

The treasury management system construction roadmap can be summarized as: from clarifying goals and strategies, sorting out processes and systems, to selecting and implementing information systems, and then through personnel training and knowledge transfer, finally achieving an efficient, transparent, and risk-controlled treasury management system.