LongRiverTech Consulting: Business Plan for Internet Online Service Platform for Liquidity Management

The Internet online service platform for liquidity management: a one-stop online service that helps users manage liquidity efficiently and conveniently.

The business plan for the Internet online service platform for liquidity management analyzes and explains the feasibility and investment value of the project from multiple aspects such as market, product, marketing, operation, finance, investment, law and compliance.

The Internet online service platform for liquidity management is an innovative online service platform that is committed to providing enterprises with comprehensive and efficient liquidity management solutions. Through intelligent data analysis, risk assessment and liquidity optimization, it helps enterprises maximize the use of funds, improve financial management efficiency and risk control capabilities, and promote the steady development of enterprises.

Liquidity is the basis for the normal operation of an enterprise. Enterprises need to ensure that they have sufficient liquidity to pay daily operating expenses, such as employee wages, rent, utilities, etc. Through effective liquidity management, enterprises can avoid operational interruptions caused by capital shortages.

With the development of internationalization, diversification, portfolioization, and business customization of enterprises, the amount and complexity of capital flows are growing rapidly, and the traditional manual management model is increasingly unable to meet the capital liquidity management needs of modern group enterprises.

Capital liquidity management is not only related to the survival of enterprises, but also affects the profitability of enterprises. Through the fine management of capital liquidity, enterprises can use funds more efficiently, reduce unnecessary waste and idleness, thereby improving the efficiency of capital use and increasing the profitability of enterprises.

Effective capital liquidity management can help enterprises identify and respond to potential financial risks in a timely manner. For example, by monitoring key indicators such as cash flow and accounts receivable, enterprises can promptly discover and solve possible capital chain problems and avoid financial crises caused by insufficient capital liquidity.

As the scale of enterprises expands and their businesses expand, the demand for capital liquidity will also increase accordingly. Through reasonable capital planning and liquidity management, enterprises can ensure that there is sufficient financial support during the expansion process, thereby achieving sustained and stable development.

The inefficiencies in efficiency and transparency of traditional manual management methods have prompted the market to gradually increase its acceptance of automated and intelligent innovative solutions.

The needs of enterprise liquidity management cover multiple aspects such as ensuring normal operation, optimizing the efficiency of capital use, reducing financial risks, supporting enterprise expansion and development, and responding to emergencies. These needs together constitute the importance and urgency of enterprise liquidity management.

Through the Internet online service platform, enterprises can grasp the status and flow of funds in real time, which is convenient for immediate fund allocation and decision-making.

The platform provides 7x24 hours of service, without time and geographical restrictions, and enterprises can operate and manage funds anytime and anywhere.

The platform is usually equipped with automated fund flow monitoring and early warning functions to reduce manual monitoring costs and improve the accuracy of fund management.

Using big data and artificial intelligence technology, the platform can provide enterprises with personalized fund management suggestions and risk assessments.

Compared with traditional fund management methods, Internet online service platforms can significantly reduce operating costs, such as reducing the use of paper documents and saving labor costs.

By optimizing fund allocation and reducing idle funds, enterprises can reduce unnecessary loan interest expenses.

The platform usually provides a wealth of financial products and services, such as short-term financing, hedging, investment consulting, etc., to meet the diverse fund management needs of enterprises.

Enterprises can flexibly choose services according to their own situation to improve the flexibility and efficiency of fund management.

The platform can be expanded according to the growth and needs of the enterprise to adapt to the development requirements of the enterprise at different stages.

Provide customized services to meet the specific fund management needs and business processes of the enterprise.

The enterprise fund liquidity management Internet online service platform has significant advantages in real-time, convenience, automation, cost-effectiveness, financial service diversification, security and compliance, as well as scalability and customization, which helps enterprises improve fund management level, optimize fund operation efficiency and reduce operational risks.

The fund liquidity management Internet online service platform aims to provide fund liquidity solutions for small and medium-sized enterprises to meet the flexible needs of enterprises for fund scheduling.

In response to the market demand for efficient fund management tools, the platform can tailor appropriate solutions based on the investment portfolio of compliant financial instruments to build an intelligent fund management system for enterprises.

Improve the efficiency of fund liquidity management through technology and obtain positive feedback and industry recognition from target customer groups.

The innovation points and competitive advantages of the fund liquidity management Internet online service platform are:

Seamless integration of common financial instruments in the international financial market;

AI-based fund flow prediction and scheduling algorithm;

User-friendly interactive interface design;

Flexible customized service solutions.

The business model and profit-making methods of the Internet online service platform for liquidity management include:

Software product license fees;

Software system customization service fees;

Software system solution consulting service fees;

Platform service subscription fees;

Value-added services such as management consulting and financial planning fees;

Cooperative financial institution recommendation service share.

The Internet online service platform for liquidity management has strong technical support and partners.

Our team members have decades of experience in the world's top financial technology companies and China's top financial technology companies.

They have served hundreds of Fortune 500 companies, commercial banks, investment banks, insurance companies, precious metals groups, automotive industry groups, energy groups, mining groups, etc.

Our continuously optimized algorithms and models are verified by partners.

We have a professional team and technology to ensure data security and privacy.

With the rapid development of Internet finance, the market size of the Internet online service platform for liquidity management continues to expand. More and more companies are beginning to pay attention to the liquidity management of funds and seek convenient and efficient online services. This market demand has promoted the development and innovation of related service platforms.

According to publicly released information, the scale of the Internet financial industry is continuing to grow, with an astonishing annual compound growth rate of more than 30%. It is expected that by 2026, the scale of the industry will exceed 50 trillion yuan.

At present, the main forms of the Internet financial market include P2P online lending, bank loan intermediaries, crowdfunding, third-party payment, Internet insurance, Internet funds, virtual currency, etc.

With the collapse of a large number of Internet financial companies and wealth management products in recent years, the barbaric and chaotic scene of the initial stage of Internet financial development has been exposed.

An industry with a market size of more than 50 trillion yuan urgently needs a professional, full-range financial instrument portfolio, legal and compliant new generation Internet financial service platform.

This data shows that the Internet online service platform for capital liquidity management has huge market potential and growth space.

The user's demand for the Internet online service platform for capital liquidity management is mainly reflected in the following aspects: convenience, security, efficiency and personalized service. Users hope to achieve rapid circulation and efficient management of funds through online platforms, while ensuring the safety of funds. In addition, as users' demand for diversified financial services increases, personalized services have also become one of the important factors for users to choose service platforms.

At present, the market for Internet online service platforms for capital liquidity management presents a diversified competitive landscape. Large Internet financial platforms such as Ant Group, Tencent Finance, and JD Finance have dominated the market with their strong technical strength, rich product lines, and a wide user base.

However, with the continuous development of the market and the intensification of competition, small and medium-sized Internet financial platforms are also rising rapidly. They have gradually occupied a place in the market by providing differentiated services and innovative products. It is expected that in the next few years, small and medium-sized platforms will gradually seize market share with their advantages and form a more intense competition with large platforms.

Existing large Internet financial platforms mainly focus on Internet technology, specialize in Internet loans and fund management, and lack depth and systematicness in financial business innovation, which usually requires decades of industry experience accumulation by the world's top financial technology companies.

Technology is one of the key factors in promoting the development of Internet online service platforms for liquidity management. With the continuous development of technologies such as artificial intelligence and blockchain, relevant service platforms are also constantly introducing these advanced technologies to improve their service quality and efficiency. For example, through artificial intelligence technology to achieve intelligent fund management and improve user experience; through blockchain technology to improve the transparency and security of financial transactions, etc.

With the rapid development of the Internet financial industry, relevant regulatory policies are also constantly improving. The government has strengthened its supervision of the Internet financial industry, aiming to regulate market order, protect investors' rights and interests, and prevent financial risks. For the Internet online service platform for liquidity management, compliance operation and risk control are the key to future development. The platform needs to pay close attention to the dynamics of regulatory policies, strengthen the construction of internal risk management mechanisms, and ensure compliance and steady development.

The platform is positioned as an online service platform that provides enterprises with one-stop liquidity management solutions, and is committed to helping enterprises improve the efficiency of capital use and reduce financial risks.

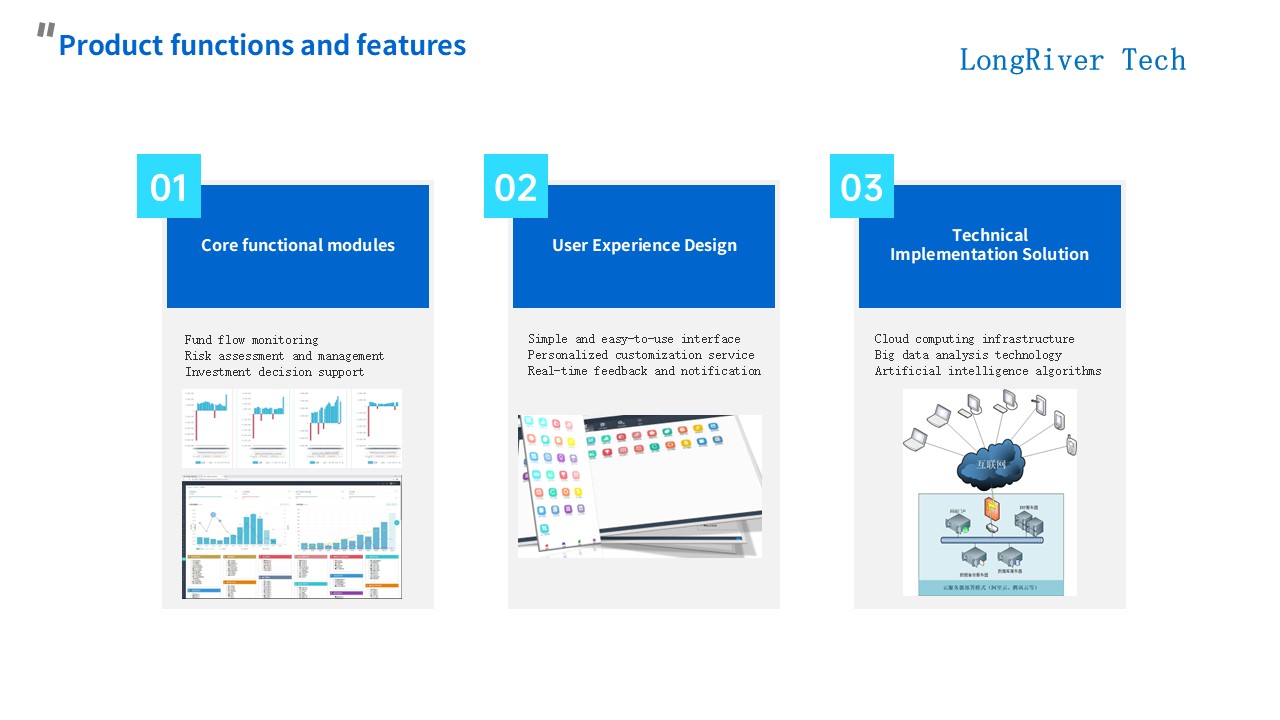

The functional design mainly includes: capital management, liquidity forecasting, risk management, financing services, data analysis and reporting.

Fund management provides functions such as fund account management, fund transfer, and fund monitoring, which facilitates enterprises to grasp the capital status in real time.

Liquidity forecasting is based on historical data and algorithm models to predict the capital liquidity needs of enterprises in the future and provide decision-making support for enterprises.

Risk management uses risk assessment models to timely discover potential capital risks and provide risk warnings and response strategies.

Financing services provide enterprises with financing channels and financing plan design to help enterprises solve the problem of capital shortage.

Data analysis and reporting provide multi-dimensional data analysis reports to help enterprises gain an in-depth understanding of the liquidity of funds and provide a basis for management decisions.

The technical architecture adopts a service architecture to achieve high availability, high scalability and fault tolerance. Through distributed deployment and load balancing technology, the platform is ensured to operate stably in high-concurrency scenarios.

Security assurance uses multiple authentication, data encryption transmission, security audit and other technical means to ensure the security of user data. At the same time, the platform is regularly scanned and repaired for security vulnerabilities to improve the platform's security protection capabilities.

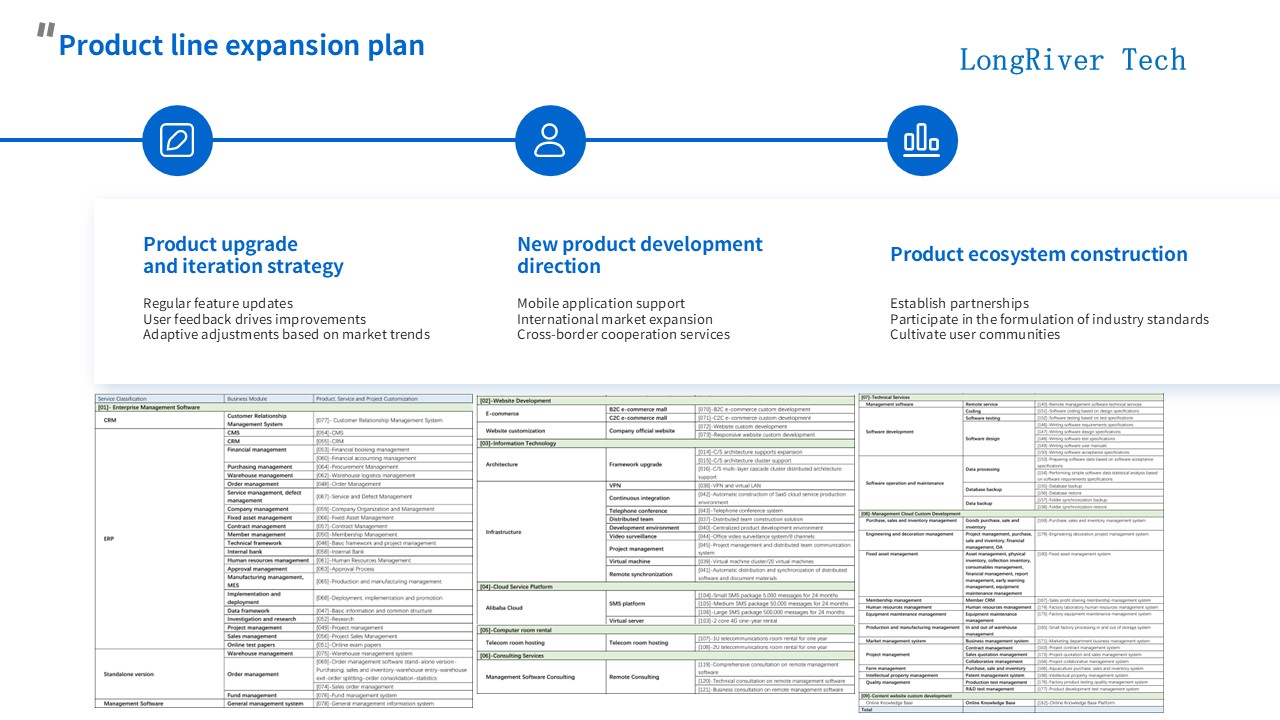

With financial tools as the core, it provides abstract quantitative modeling and digital transformation support for the main business of customer enterprises, integrating ERP, e-commerce platforms, and online order management platforms.

On the basis of continuously improving existing functions, it gradually expands new business areas, such as supply chain finance and corporate credit management. At the same time, it actively seeks cooperation with financial institutions to provide enterprises with more abundant financial services.

According to user feedback and market demand, it regularly iterates and updates products. Focus on optimizing user experience and operating processes to improve the usability and stability of the platform. At the same time, it continuously introduces new technologies and functions to meet the changing needs of users.

Expand the platform's visibility and influence through a combination of online and offline methods. Online, use social media, online advertising and other channels for publicity and promotion; offline, participate in industry exhibitions, hold seminars and other activities to establish connections with target customers.

Provide free trial services and preferential activities to attract more companies to join the platform. At the same time, establish a complete customer service system to promptly solve problems encountered by users during use and improve user satisfaction.

Brand building and promotion include: partnership establishment, marketing activity planning and implementation, brand positioning and communication channels.

Establish strategic partnerships with financial institutions, industry associations and e-commerce platforms.

Jointly develop innovative products to expand service scope and user groups.

Exchange resources and data to achieve mutual benefit and win-win results.

Regularly hold online promotional activities to attract new users to register and use.

Cooperate with well-known companies in the industry to jointly hold public welfare lectures and seminars to enhance brand image.

Develop a user recommendation plan to encourage existing users to invite new users to join.

Aiming at the fund management needs of small and medium-sized enterprises and individuals, it is positioned as a professional, convenient and secure online service platform.

Disseminate through multiple channels such as social media, search engine optimization and partner promotion.

Use big data analysis to accurately locate target customers and enhance brand awareness.

User growth strategies include: user acquisition and retention strategies, user experience optimization and feedback mechanisms, value-added services and product bundling sales.

Provide personalized services and discounts to attract users to register and use.

Establish a user points system and membership system to improve user activity and loyalty.

Send market analysis and financial advice regularly and provide value-added services.

Continuously optimize the website interface and operation process to improve user experience.

Establish user feedback channels to collect user opinions and suggestions in a timely manner.

According to user feedback, quickly respond to user needs, adjust and improve services.

Provide value-added services such as investment consulting, financial planning and insurance planning.

Design joint products with partners to achieve product bundling sales.

Improve user stickiness and platform revenue through value-added services.

The operation management of the Internet online service platform for liquidity management needs to comprehensively consider the platform positioning, user groups, operation strategies, marketing promotion, team building, human resources, content operation, data analysis, user services, after-sales support, risk control, compliance management, and continuous improvement and optimization. Through continuous optimization and improvement, the platform will be able to provide enterprises with more efficient and convenient liquidity management services.

The team building and human resources operation of the Internet online service platform for liquidity management include: team organizational structure and division of responsibilities, talent recruitment and training plans, performance appraisal and incentive mechanisms.

Clarify the responsibilities and tasks of each team member to ensure efficient collaboration.

Establish special teams such as project management, technology development, and marketing.

Regularly conduct team training and capacity improvement.

Formulate talent recruitment strategies to attract outstanding talents to join.

Establish a complete training system to improve the comprehensive quality of employees.

Regularly conduct performance evaluations to provide employees with promotion opportunities.

Establish a scientific and reasonable performance appraisal system to ensure that team goals are consistent with company goals.

Provide competitive salary and benefits to motivate employees.

Establish an incentive mechanism to commend and reward outstanding employees.

Content operation and data analysis are crucial.

Regularly publish high-quality content to attract user attention.

Use data analysis tools to understand user needs and behaviors and optimize operation strategies.

Continuously track and analyze platform data to provide support for decision-making.

User service and after-sales support are the basic guarantee for the sustainable development of the platform.

Provide 7x24 hours online customer service to answer user questions.

Establish an after-sales support team to ensure that user problems are solved in a timely manner.

Regularly collect user feedback to optimize service processes and experience.

Risk control and compliance management are the rigid needs of the operation of the Internet online service platform for capital liquidity management.

Establish a sound risk control system to prevent potential risks.

Comply with relevant national laws and regulations to ensure compliance with platform operations.

Conduct internal audits regularly to ensure healthy and stable company operations.

The financing demand of the Internet online service platform for liquidity management is about 15 million yuan, mainly from long-term strategic investors, and the transfer of no more than 10% of the equity.

The capital investment is mainly used for: technology development costs, marketing and advertising expenses, and operation and maintenance costs, each accounting for about one-third.

In order to control investment risks and maximize the protection of investors' interests, a conservative investment strategy has been formulated, with an estimated minimum investment of about 5.8 million yuan, mainly used for technology research and development and market development investment in the first two years.

For strategic investments with a high risk preference and sufficient investment cash, an aggressive investment strategy can be adopted and implemented in accordance with the 5-year investment plan of 15 million yuan.

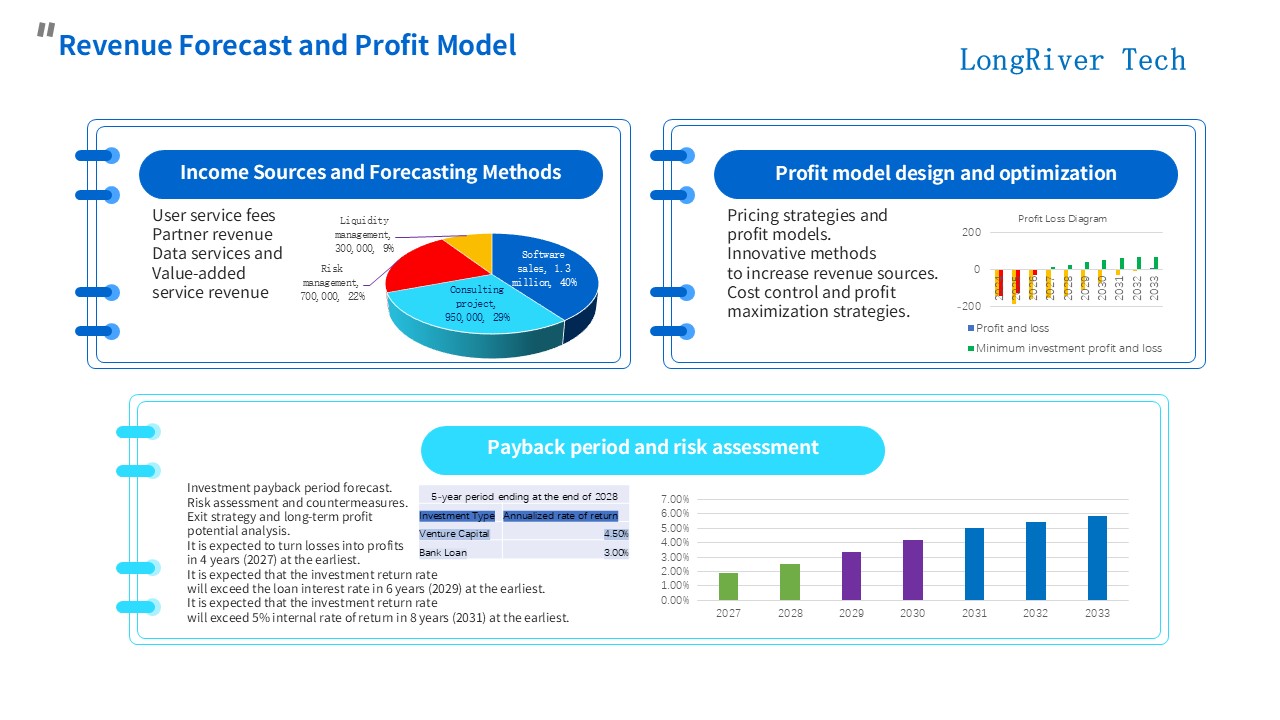

In the early stage of this project, the traditional financial technology company business model is inherited, with software sales revenue as the main source and consulting revenue as the supplement.

After the establishment and improvement of the upstream and downstream interest chain relationship and legal compliance operation system, it will gradually transform into a risk management and liquidity management SaaS service platform business model.

The final source of income is composed of user service fees, partner income, data services and value-added service income.

This project adopts a conservative investment strategy and is expected to start making profits in 2027, four years at the earliest. In the case of sufficient funds and slightly greater risk appetite, an aggressive investment strategy is adopted, and it is expected to start making profits in 2033, 10 years later.

Long-term strategic investors can exit through long-term financial investment, or exit through a higher-level ecosystem or long-term holding, or even further invest.

If financial investors are introduced later, the return on investment is expected to exceed the loan interest rate in six years at the earliest, and the return on investment is expected to exceed 5% internal rate of return in eight years at the earliest.

For the Internet online service platform for liquidity management, law and compliance are the basis and guarantee of operation. The platform should always pay attention to the updates and changes of relevant laws and regulations, and adjust its own operating strategies and management systems in a timely manner to ensure continuous compliance operations. At the same time, the platform should also focus on improving risk management capabilities, ensuring the security of funds and user information, and providing users with safer, more efficient and convenient services.

When managing liquidity, online service platforms must strictly comply with laws and regulations such as the Company Law, the Securities Law, the Banking Law, the Futures and Derivatives Law, and industry norms such as the Fund Management Guidelines and the Corporate Financial Management Standards, as well as trading rules and regulatory compliance for exchange-traded financial instruments. These laws and regulations clarify the source, destination, disposal and management methods of corporate funds to ensure the compliance and standardization of fund management.

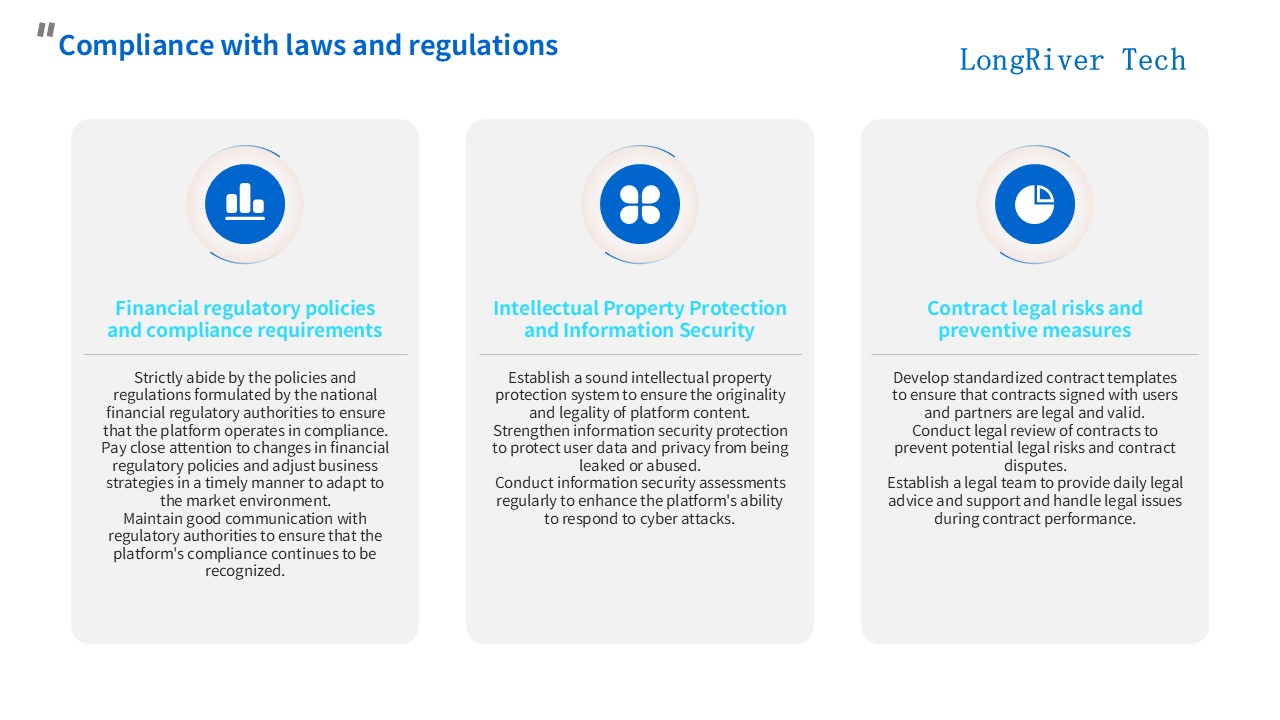

Strictly comply with the various policies and regulations formulated by the national financial regulatory authorities to ensure that the platform operates in compliance.

Pay close attention to changes in financial regulatory policies and adjust business strategies in a timely manner to adapt to the market environment.

Maintain good communication with regulatory agencies to ensure that the platform's compliance is continuously recognized.

Establish a sound intellectual property protection system to ensure the originality and legality of platform content.

Strengthen information security protection to protect user data and privacy from being leaked or abused.

Conduct information security assessments regularly to enhance the platform's ability to respond to cyber attacks.

Develop standardized contract templates to ensure that contracts signed with users and partners are legal and valid.

Conduct legal review of contracts to prevent potential legal risks and contract disputes.

Establish a legal team to provide daily legal advice and support, and handle legal issues in the process of contract performance.

Compliance construction and auditing include: internal control system and process design, compliance training and culture construction, regular auditing and risk assessment.

Establish a sound internal control system to supervise and manage risks in the platform operation process.

Optimize business processes to ensure the standardization and efficiency of operations.

Regularly review and update the internal control system to meet the needs of business development.

Regularly organize compliance knowledge training to improve employees' compliance awareness and legal literacy.

Build a compliance culture so that every employee can follow laws and regulations in their daily work.

Establish a compliance reward mechanism to encourage employees to actively discover and report potential compliance issues.

Conduct internal and external audits regularly to ensure that the platform operation complies with laws, regulations and internal control requirements.

Conduct risk assessments, identify possible legal and compliance risks, and formulate countermeasures.

Optimize compliance management strategies and processes based on audit and risk assessment results.

The Fund Liquidity Management Internet Online Service Platform project is closely centered on the needs of enterprises. Through advanced technology and professional services, it is committed to providing enterprises with efficient and secure fund management solutions. We believe that with the continuous expansion of the market and the continuous advancement of technology, this project will usher in broad development prospects. We look forward to working together with all partners to create a better future.